The impact of Donald Trump's tariffs on Jaguar Land Rover has been brought to light as the luxury car manufacturer detailed its vehicle exports to the US for the first quarter of 2025. The Coventry -based automotive giant reported a 14.4% increase in wholesale volumes in North America during its fourth quarter, as reported by City AM. This information comes following Jaguar Land Rover's announcement over the weekend that it will "pause" shipments to the US while it adjusts to "address the new trading terms" that have arisen as a result of Donald Trump's tariffs. The US administration enforced a 25% tariff on all foreign cars starting Thursday, complemented by a broader "baseline" tariff of 10% on goods imported globally which commenced on Saturday morning. In a statement issued on Saturday, a spokesperson for Jaguar Land Rover commented: "The USA is an important market for Jaguar Land Rover's luxury brands." They added, referencing their response to the tariffs: "As we work to address the new trading terms with our business partners, we are taking some short-term actions including a shipment pause in April, as we develop our mid- to longer-term plans." The details of US wholesale figures come ahead of Jaguar Land Rover releasing a comprehensive set of data before its full-year results for the 12 months up to the end of March 2025, which are expected to be announced in May. In its most recent quarter, the group's wholesale volumes, excluding the Chery Jaguar Land Rover China joint venture, reached 111,413 vehicles. This represents a 6.7% increase compared to the previous three months and a 1.1% rise year on year. When compared to the previous year, wholesale volumes in Europe increased by 10.9%, while in the UK they remained flat at 0.8%. However, the group experienced a significant 29.4% decline in China, and overseas sales fell by 8.1%. Retail sales for the fourth quarter, including the Chery Jaguar Land Rover China joint venture, totalled 108,232 vehicles. This is a decrease of 5.1% compared to the same quarter last year but an increase of 1.8% compared to the preceding three months.

A risky mortgage instrument that helped spark the Global Financial Crisis is on the rise, but three things are different this time around.Recommended VideoAdjustable-rate mortgages (ARMs), once the villain of the subprime meltdown, are surging in popularity as homebuyers look for savings in a high-rate era. The share of ARMs reached nearly 13% of all mortgage applications this fall, per the Mortgage Bankers Association, the highest level since 2008.For buyers today, the lure is clear: ARMs offer starting rates about a full percentage point lower than fixed-rate loans, making the difference between buying a home or staying sidelined. The typical 5/1 ARM has an interest rate in the mid-5% range, compared with the 30-year fixed rate’s 6.3% and above. On a $400,000 loan, that initial discount translates into $200 or more in monthly savings, enough to tip the scales for first-time buyers or those seeking a larger property. But every ARM, by definition, is a wager: After the initial fixed period—often five, seven, or 10 years—the interest rate resets, adjusting with the broader market. Today, that means buyers are betting the Federal Reserve will cut rates before their loan recalculates. If the Fed delivers on anticipated rate drops in December, customers could see payments shrink further or at least avoid big jumps when the adjustment arrives.Back in the mid-2000s, adjustable-rate loans contributed to a financial calamity. Easy credit, teaser introductory rates, and lack of oversight meant millions of Americans took out loans with initially low payments, only to see costs soar when interest rates reset. ARMs then accounted for as much as 35% of mortgage originations, fueling both a housing bubble and the crash that followed. Fast-forward to 2025, and some are justifiably anxious at the product’s resurgence.Borrowers aren’t just gambling with their own fortunes, though. This time, banks and regulators have changed the rules. Today’s ARMs come with strict documentation standards, borrower protections, and built-in caps designed to prevent the shock resets that hammered millions of families in the last crisis. Lenders scrutinize income, debt, and credit quality, and loans are calibrated to ensure that, even if rates go up, buyers won’t be caught entirely off guard. Pre-crisis, some ARMs changed rates almost overnight, but most modern loans fix the initial rate for several years and limit increases through legal ceilings.Risks this time aroundStill, the instrument carries risk—especially if the Federal Reserve changes course. If rates rise unexpectedly, those low initial payments can balloon, exerting pressure on household budgets just as the broader economy absorbs the impact.Unlike the pre-crisis era, buyers are appearing to use ARMs as financial tools for specific strategies, rather than gambling on ever-increasing home values. The trend centers on affordability: With 30-year fixed rates still elevated (averaging near 6.3%), ARMs offer an initial fixed period at rates nearly a full percentage point lower, sometimes saving hundreds per month. And the current vogue appears to reflect an educated guess—or a gamble, depending on your position—that interest rates, and therefore mortgage rates, will continue to decline in the near future.Michael Pearson, senior VP of business development at A&D Mortgage, told Realtor.com earlier this month that “the common wisdom is that interest rates will continue to dip lower, slowly over the next couple of years. So although ARMs offer only short-term fixed interest rates, there may be more opportunities to lock into long-term lower rates in the coming years.” For many, this lower payment is seen as a bridge until rates drop, jobs relocate, or life changes; borrowers are actively planning to refinance, move, or pay off loans before the adjustable period kicks in.In high-cost markets, the pressure to choose ARMs is strong. With fixed mortgage rates remaining stubbornly high after years of Fed rate hikes, buyers are willing to roll the dice on interest rates. Some see ARMs as the only path to homeownership, wagering that central bankers will cut rates as inflation cools off. The harsh reality is that prospective homeowners don’t have much of a choice. A recent Redfin analysis found that America hasn’t been this stuck in terms of housing mobility for at least 30 years, with just roughly 28 out of every 1,000 homes changing hands between January and September. “It’s not healthy for the economy that people are staying put,” said Daryl Fairweather, chief economist at Redfin. The so-called home sales turnover rate through the first nine months of this year is down about 30% from the average rate over the same time periods between 2012 and 2022. Ultimately, the surge in ARM loans is both a sign of tight economic times and renewed risk-taking. While regulatory guardrails may prevent the kind of crash seen in 2008, the outcome for individual borrowers still depends on what the Fed does—and whether buyers truly understand the gamble they’re taking. For now, a controversial loan product is back in the spotlight, and the housing market is holding its breath for the next move from the central bank.For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.

President Donald Trump played down the significance of his proposed 50-year mortgage plan in a recent interview, calling it “not even a big deal… it might help a little bit,” during a segment on Fox News with Laura Ingraham. The idea, which aims to extend mortgage terms for Americans, has triggered a wave of criticism across the political spectrum, as Ingraham noted, with some labeling it a financial trap for homebuyers and a windfall for banks.Recommended VideoIn the interview aired onThe Ingraham Angle, the Fox host pressed Trump on the impact of his housing proposals, including the much-discussed 50-year mortgage concept. Housing costs, Ingraham noted, are pushing the average age of first-time buyers to 40—“sad for the country,” she remarked. Trump defended the policy by saying he “inherited” the predicament and characterized the shift from traditional 30-year to potential 50-year mortgages as minor: “It’s not even a big deal … all it means is you pay less per month, you pay it over a longer period of time. It’s not, like, a big factor. It might help a little bit,” Trump insisted.Trump’s housing director, Bill Pulte, was much more positive on the idea’s impact. “Thanks to President Trump, we are indeed working on The 50-year Mortgage – a complete game changer,” the Federal Housing Finance Agency Director Bill Pulte said Saturday in a statement released on social media.Trump further argued that the more pressing issue was the spike in interest rates, blaming President Biden and Federal Reserve Chair Jerome Powell—whom he referred to as “Too Late”—for sluggish responsiveness. Trump assured viewers that interest rates would come down, but defended the overall strength of the economy under his stewardship: “Even with interest rates up, the economy is the strongest it’s ever been,” he asserted.Ingraham raised the issue of people saying they have significant anxiety about the economy in the electorate, and Trump pushed back. “I don’t know that they are saying that. We’ve got the greatest economy that we’ve ever had.”Ingraham and critics push backThe plan didn’t escape harsh scrutiny, including from Ingraham herself. She pointed out that the backlash wasn’t coming just from Democrats but also from within Trump’s own base, who characterize extended mortgages as giveaways to banks and mortgage lenders. She said Trump’s base was “enraged” and asked him about a “significant MAGA backlash, calling it a giveaway to the banks and simply prolonging the time it would take for Americans to own a home outright. Is that really a good idea?” Ingraham asked.On social media and in public statements, several Republican figures lashed out at the proposal. Rep. Thomas Massie (R-KY) compared the idea to having no real ownership at all, asking, “How is ‘here, enjoy this 50 year mortgage’ different from ‘you will own nothing and you will like it?’” Rep. Marjorie Taylor Greene (R-GA) worried the plan would “ultimately reward the banks, mortgage lenders and homebuilders while people pay far more in interest over time and die before they ever pay off their home. In debt forever, in debt for life!”Conservative media voices echoed these concerns. Glenn Beck described the plan as “almost like… ‘you will own nothing and be happy.'”Bloomberg Opinion’s Allison Schrager, on the other hand, wrote on Tuesday that it’s a good idea, with the market clearly expressing a need for something like the 50-year mortgage to exist. It’s “not a terrible idea,” she wrote, adding that while people who sell their homes before their mortgage matures will get less value, “that may be a worthwhile tradeoff for someone who needs or wants a lower monthly payment.” Still, she added she’s concerned it will be difficult to price and she still has some deep concerns about the idea.

ShareResizePhoto: Timon Schneider/Getty ImagesThis is an online version of Financial News’s wealth management newsletter. To subscribe click hereThis week has felt like the end of an era for several titans of wealth management.

The luxury car giant behind Jaguar and Range Rover says it is confident its business will be “resilient” despite Donald Trump’s new 25% tariffs on automobiles. The US president has imposed a 10% tariff on US imports of UK goods, rising to 25% for cars. Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT), called the news “deeply disappointing and potentially damaging”. The USA is a key market for JLR, formerly Jaguar Land Rover. Last year JLR chose Miami Art Week to launch its Type 00 Jaguar concept vehicle. The car was designed with a theme of “Exuberant Modernism” and the company says it is “a concept with bold forms and exuberant proportions to inspire future Jaguars”. JLR’s North American business is based in Mahwah, New Jersey, and its LinkedIn page says the company “is represented by more than 330 retail outlets”. Analysis this week from the Institute for Public Policy Research (IPPR) showed more than 25,000 direct jobs in the UK car manufacturing industry could be at risk under the new tariff regime as exports fall. And the IPPR said employees at Jaguar Land Rover and Mini were set to be among the most exposed. In a statement, JLR said: “Our luxury brands have global appeal and our business is resilient, accustomed to changing market conditions. Our priorities now are delivering for our clients around the world and addressing these new US trading terms.” In January, JLR posted a pre-tax profit of £523m for the final three months of 2024, down from the £627m reported during the same period in 2023, as reported by City AM. But its pre-tax profit for the 12 months to date stood at £1.6bn, a 7% year-on-year increase. Also in January, JLR said it was investing millions of pounds in new paint facilities at its Castle Bromwich site to help it meet demand for personalised luxury vehicle, where customers pick from hundreds of bespoke paint options across its Range Rover and Range Rover Sport models In September, JLR announced plans for a £500m investment at its Halewood factory in Merseyside to turn it into the “electric vehicle factory of the future”. Mike Hawes from the SMMT said: “The announced imposition of a 10% tariff on all UK products exported to the US, whilst less than other major economies, is another deeply disappointing and potentially damaging measure. “Our cars were already set to attract a punitive 25% tariff overnight and other automotive products are now set to be impacted immediately. “While we hope a deal between the UK and US can still be negotiated, this is yet another challenge to a sector already facing multiple headwinds. “These tariff costs cannot be absorbed by manufacturers, thus hitting US consumers who may face additional costs and a reduced choice of iconic British brands, whilst UK producers may have to review output in the face of constrained demand. 15 stunning pictures of Jaguar's new electric vehicle as Type 00 is launched in Miami “Trade discussions must continue at pace, therefore, and we urge all parties to continue to negotiate and deliver solutions which support jobs, consumer demand and economic growth across both sides of the Atlantic.” Dr Jonathan Owens, operations and supply chain expert at the University of Salford, said: “While the tax on parts might not take effect until May, the new US tariff import policy imposing a global 25% tax on fully assembled and saleable vehicles has already begun. For vehicles already in the supply chain to the US from the UK and other global destinations, automotive manufacturers will probably have to take the hit short-term for the increases as the price negotiations have been completed. “However, if the global US tariff becomes a permanent fixture by the Trump administration, automotive companies will not be able to carry the long-term burden of the increased costs. This will become more noticeable when the tariff tax is expanded to the parts supply chain. The assembly of a vehicle requires parts coming into a centralised manufacturing plant, however there will also be decentralised smaller plants and suppliers offering specialised services. Subsequently, component parts in the assembly may cross multiple borders accumulating tariff costs. So, when the tariff on parts takes place, it will only further increase the cost of the vehicle. “We should also consider this was attempted in Trump’s first presidential office to protect US steel jobs, with a 25% global tariff on imported steel. However, this resulted in a lower job tally of 80,000, compared to the 84,000 it had been in 2018. “Will it last and is the UK right not to retaliate immediately? The US public will not be isolated to these increases due to the supply chains. If US manufacturers are to bring everything in-house, it would take many years and not everything can be sourced within the US. The US citizen could soon find the price of locally made cars increasing and the option to buy cheaper imports has also become too expensive. The situation is far from ideal for a nation who like their cars.”

ShareResizeBarclays private bank and wealth management chief executive Sasha Wiggins says government’s flagship campaign ‘will help make investing an everyday reality for more people’.Barclays’ wealth boss Sasha Wiggins has been selected to chair chancellor Rachel Reeves’ new retail investment campaign.Wiggins, who is chief executive of Barclays’ private bank and wealth management business, will spearhead the government’s flagship initiative, which aims to unlock greater investment in the UK economy.

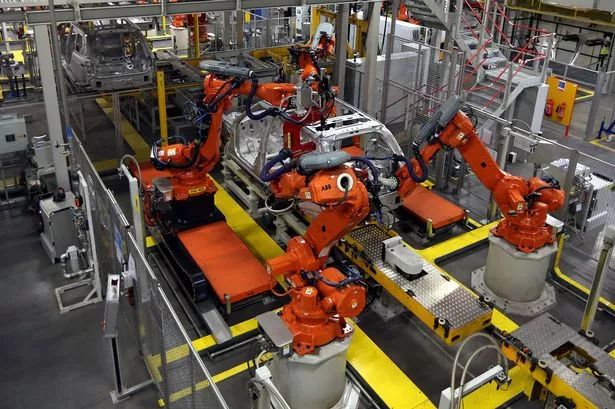

Flooring manufacturer Airea says investment into its factory capabilities is expected to bring benefits in the third quarter, following strong sales growth but a fall in profits. The carpet tile specialist which owns the Burmatex brand saw 6% sales growth in the second half of 2024, despite a weaker first half in which bosses say announcement of the General Election had brought about cancellations in key public sector work. Full year revenue was up 0.6% to £21.2m and operating profit before valuation gain was down from £1.8m to £700,000, having been impacted by £900,000 worth of costs associated with investment. Airea has been implementing a £5m overhaul of its factory set-up with the introduction of new equipment, including robotics. The work has impacted the AIM-listed firm's bottom line in the short term, but CEO Médéric Payne told BusinessLive he was eager to get the systems running - as commissioning of the equipment could start from June. In full year 2024 results, investors were told of momentum behind the business - and were given a final dividend of 60p per share, up from 55p per share in 2023 and the fourth consecutive year of dividend growth. Airea has said it is well placed for future profitable growth. Asked about markets the firm is looking to grow in, Mr Payne said: "We're doing a bit more in hospitality than we have done traditionally - so that's encouraging. And we're doing a lot more on white label and selling to other manufacturers who want our product but under their brand or credentials. "Some of those are new customers who are wanting to purchase more locally, rather than far away, overseas, and where they've got more control over supply chain. And also, our capabilities are such that we are prepared to do it now." He added: "Bearing in mind, having just done this investment into the factory, and having doubled capacity, we also need to be able to increase - and 'feed the monster' as I say in the office - and to make sure we have enough orders to make sure the investment was worthwhile." In January, post year end, Airea launched a showroom and warehouse operation in Dubai - which Mr Payne said signalled where the business saw growth opportunities. That facility is intended not only as a gateway to Middle East work but also further afield, with the company having identified Dubai as hub to host clients from markets such as Africa. Within the results, chairman Martin Toogood said: "The group was pleased with the positive momentum in the second half of the year. This encouraging performance was delivered despite the ongoing global economic and geopolitical challenges. "We made further progress in expanding our sustainable portfolio with the launch of several carbon-neutral products both in the UK and in our key target overseas markets. The opening of the group's new showroom in Dubai in January 2025 is another example of our investment for future growth. This will operate as a strategic hub to drive sales across the GCC, MEA regions and India.