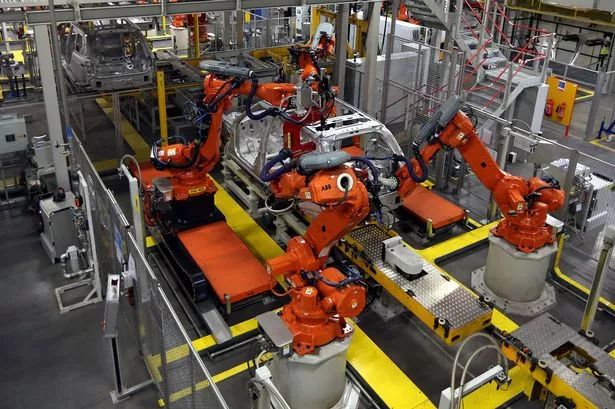

Production volumes and turnover have jumped at Nissan's Sunderland factory, but a reorganisation of the business has seen it take on more costs. New accounts for Nissan Motor Manufacturing (UK) Limited show 325,000 cars rolled off the production line at the Wearside plant in 2024, compared with 260,000 the year before. Clearing disruption from worldwide semiconductor chip shortages over recent years was said to have helped the factory ramp up numbers with the Qashqai remaining the brand's biggest seller and one of the UK's top 10 models, of which 199,000 left for UK and European showrooms. Turnover was boosted from £5.03bn to £7.35bn in the year to the end of March 2024, as cost of sales crept up from £4.67bn to £6.92bn. But the plant swung to a loss during the year - recording an operating loss of £41.2m, from an operating profit of £49.4m a year earlier. Bosses said the losses had partly been caused by provisions for supplier claims amounting to £214m - including costs associated with onsite supplier activity and where there had been unforeseen changes to production schedules, along with price inflation. An internal shake-up of how Nissan is organised has also given the Sunderland plant a new status within the global group, making it liable for vehicle warranty costs where defects may have cropped up in the first three years or 100,000km of the vehicles it makes. The changes are said to have given the company more importance and prominence within the Japanese group. Staffing levels also increased during the year - with headcount reaching nearly 7,000. That was said to have been driven by the increased production volumes and additional design staff needed for future electric vehicle projects. The Sunderland plant is preparing to start making the third generation Leaf later this year, with new look Juke and Qashqai models revealed during last year. In recent weeks, Nissan issued images of a trio of models - including the third generation Leaf, as well as an all-electric Juke and the return of the Micra - which it hopes will do well in the European market. Results for Nissan's Sunderland operation, which has been there since the mid 1980s, are set against a challenging time for the Japanese multinational, which has been facing falling sales, financial challenges and a botched merger attempt with rivals Honda. Those difficulties have prompted a major restructuring of the business including slashing production and plans to shut three plants, including one in Thailand and two, as yet, unidentified.

ShareResizeHelen Watson will hand the reins of Rothschild's UK wealth business to current deputy UK CEO James MorrellWant the latest news from FN? Just follow us on WhatsApp hereRothschild & Co has chosen a successor for UK wealth head Helen Watson as she moves to chair of the business.

Mortgage rateshave remained stubbornly high: hovering at more than 6%, well above the sub-3% rates during the pandemic. That makes homeownership increasingly unaffordable for many Americans, as home prices have risen more than 50% since 2020.During the pandemic, home buyers got accustomed to sub-3% mortgage rates, which made purchasing a house feel more achievable. But in the past couple of years, buyers have had no such luck.Recommended VideoIn late 2023, mortgage rates peaked at 8%. They’ve let up some, today’s 30-year fixed mortgage rate is 6.19%, according to Mortgage News Daily, but economists and real-estate groups have warned they don’t see that figure budging much in the near future. And to make matters worse, some have said the mortgage rate it would take to make homes feel affordable again isn’t achievable. This summer, Zillow economic analyst Anushna Prakash reported mortgage rates would need to drop to 4.43% for a typical home to be affordable to an average buyer. But “that kind of a rate decline is currently unrealistic,” Prakash wrote. Meanwhile, not even a 0% interest rate would make a typical home affordable in New York, Los Angeles, Miami, San Francisco, San Diego, or San Jose, she added. Warren Buffett’s Berkshire Hathaway HomeServices also said in an early July report mortgage rates are one of the main deterrents for both home buyers and sellers.“Many homeowners are reluctant [to] put their homes on the market and give up the low mortgage rates they already have,” according to Berkshire Hathaway HomeServices. “To them, high price gains won’t mitigate their ability to pay more for another home at significantly higher interest rates.”This issue is also referred to as golden handcuffs—or the locked-in mortgage rate effect. The idea is that current homeowners have no incentive to put their homes on the market, even if they want to move, because they’d forgo a much lower mortgage rate they had locked in years ago. This causes a litany of other problems in the housing market, namely inventory.The homebuilder unsold completed inventory recently hit a 16-year high, according to ResiClub, and data from real estate intelligence platform Parcl Labs shows the number of active listings on the market this summer rose to 3.06 million, a 4.9% increase from the same time last year. Meanwhile, more sellers delisting their properties after sitting on the market for longer than expected.“Homes are sitting on the market nearly three weeks longer than last year,” Realtor.com Senior Economist Jake Krimmel recently toldFortune. “That’s a sign of sellers still anchored to pandemic-era prices even though the market is telling them otherwise.” That doesn’t mean there’s an influx of housing in the U.S.; in fact, we’re still short millions of units. It just means there aren’t enough people who can actually afford to buy a home.The factors influencing housing affordabilityAlthough inventory levels are increasing, home prices and mortgage rates continue to be a roadblock for potential home buyers. Mortgage rates have remained “stubbornly high,” Berkshire Hathaway HomeServices said, deterring new buyers from the market.According to an October Realtor.com report, the typical home spent 62 days on the market in July, roughly as long as it took to sell before the pandemic.Mortgage rates are certainly a factor among buyers when deciding to make an offer, and home prices are also up more than 50% since the onset of the pandemic, according to the U.S. Case-Shiller Home Price Index.All the while, wages haven’t grown at the same pace as home appreciation, making buying a house feel even more unaffordable. And if nothing changes like mortgage rates, inventory, or wage growth, it’s likely the housing affordability crisis in the U.S. will persist, Alexandra Gupta, a real-estate broker with The Corcoran Group, toldFortune.“Some first-time buyers are turning to long-term renting or even co-living models because the idea of owning a home has become so out of reach. Others are relying more on family support to get into the market,” Gupta said. “We’re seeing a reshaping of the housing ladder.”The small glimmer of hope, though, is home price growth appears to be slowing, according to the Case-Shiller indices.“With affordability still stretched and inventory constrained, national home prices are holding steady, but barely,” Nicholas Godec, head of fixed-income tradables and commodities at S&P Dow Jones Indices, said in a statement.A version of this story originally published on Fortune.com on July 31, 2025.Fortune Brainstorm AIreturns to San Francisco Dec. 8–9 to convene the smartest people we know—technologists, entrepreneurs, Fortune Global 500 executives, investors, policymakers, and the brilliant minds in between—to explore and interrogate the most pressing questions about AI at another pivotal moment. Register here.

ShareResizeListen(2 min)Photo: Getty ImagesA year ago this month,Financial Newsstarted covering the wealth management sector. The rationale remains clear: demographic and technological shifts are upending the sector, which has had a huge impact on dealmaking, regulation and more.We’ve been thrilled with the response from our readers so far. But we’re not done yet.To mark the anniversary, we’re publishing a whole host of exclusive news, interviews and features to get your teeth into.We’ve gone inside the collapse of Schroders Personal Wealth, interviewed the new head of Rathbones’ wealth business, scooped a corporate bond push at RBC, taken a deep dive into private assets, and asked top bankers and lawyers for their M&A predictions.We’ve also asked some of the biggest names in the sector to chip in with op-eds on everything from private equity’s pursuit of the sector to the impact of AI and the race for global wealth.Remember: you’ll need a subscription to read it all. If your company doesn’t already have one, you can request a trial by emailing licensing@fnlondon.com.And to make sure you don’t miss out on even more must-reads, subscribe to our wealth management newsletter here.Thanks again for the support so far, and happy reading.Write toJustin Cash at justin.cash@dowjones.com and Kristen McGachey at kristen.mcgachey@dowjones.com

New York City Mayor-elect Zohran Mamdani swept to victory Tuesday evening on a platform of affordability, anchored by a plan to freeze rents across nearly 2 million rent-stabilized apartments. Recommended VideoBut economists, universally, hate rent control. In a 2012 poll of top economists, just 2% agreed that rent-control laws have had “a positive impact” on the supply and quality of affordable housing. The Nobel laureate Richard Thaler even quipped in the survey that the next question should be: “Does the sun revolve around the Earth?”Why do economists revile a plan that seems to promote fairness and equity in a housing market that is clearly broken? Seductive simplicityTo most voters, freezing rents looks like common sense: If prices are out of reach, stop them from rising. But to economists, that’s like treating a fever by breaking the thermometer: It suppresses the symptom without curing the disease, the persistent shortage of housing.“Freezing rents doesn’t fix scarcity,” said David Sims, a Brigham Young University economist whose research on Massachusetts rent control remains a touchstone. “It just reshuffles who bears the cost.”Sims’s work examined the rent-control regime that once governed Cambridge, Mass., where tenants could stay indefinitely at below-market rents. The policy was meant to keep housing affordable, but it led to what he calls misallocation. “People who could do better by moving tend to stay,” he toldFortune. “Older households hang on to large units they no longer need, while young families can’t find space. Over time, you end up with the wrong people in the wrong apartments.”When Massachusetts voters repealed rent control in 1994, property values in Cambridge rose 45%—not only for the deregulated apartments, but for entire neighborhoods. It turned out that years of capped rents had discouraged investment and dragged down surrounding property values, meaning that when controls were finally removed, landlords were empowered to upgrade and renovate their apartments. Neighborhoods that had been frozen along with the rents suddenly seemed to revitalize. That dynamic is already visible in New York. According to the city’s Housing and Vacancy Survey, roughly 26,000 rent-stabilized apartments are sitting empty, many uninhabitable because renovation costs far exceed what landlords can legally recover. The state’s 2019 Housing Stability and Tenant Protection Act caps recoverable renovation expenses at $50,000 spread over 15 years. Rehabilitating a century-old tenement can cost twice that, leaving owners little incentive to do anything but lock the door.Short-term relief, long-term painRent control’s immediate benefits, for current residents, are undeniable. It offers stability to tenants living paycheck-to-paycheck and reduces the risk of displacement. But over the long term, economists argue it functions the same way as throwing sand in the gears of the housing market. Landlords defer maintenance they can’t recoup, new construction slows, and the available housing stock quietly erodes.A 2018 Stanford study led by Rebecca Diamond, one of today’s leading experts in housing markets, found that when San Francisco expanded rent control in the 1990s, the supply of rental housing fell 15% over the next decade. Many landlords converted apartments to condos or owner-occupied housing to escape regulation. The policy helped existing tenants, but ultimately raised market rents citywide and accelerated gentrification, causing the opposite of what policymakers intended.“It’s not about pitying landlords,” Sims said. “It’s about understanding incentives. You can’t expect people to invest in something if they’ll never break even—just like you can’t expect tenants to volunteer to pay more rent.”For economists, the deeper problem with rent freezes is conceptual: They imply that affordability can simply be decreed against the logic of supply and demand. “It creates this belief that the problem can be solved by fiat,” Sims said. “But rents are high because people want to live in New York. The only lasting fix is to make it easier to build more housing that people actually want.”He offers a visceral analogy of market pressures: Black Friday. People don’t wait in line for stores anymore on Black Friday, Sims said, but there was a time when, for a $1,000 TV at $200, there’d be a line around the block at 4 a.m., and only a few lucky people would get the TV.“But housing isn’t like a $200 TV,” Sims observed. “Everyone kind of needs a place to live, but if housing is priced like the $200 TV, then there’s a bunch of people in that line who don’t get it.”That’s the thing about rent control, economists say: It benefits insiders at the expense of outsiders. Over time, it can deepen inequality by keeping younger, lower-income, or newly arrived residents locked out of regulated neighborhoods that effectively become closed clubs.Band-Aid policy in a broken marketSupporters of Mamdani’s plan counter that New York’s crisis is so severe, temporary freezes are a moral necessity. With median rents above $4,000, they argue, the city cannot wait for zoning reforms and construction projects that take years to materialize. But even sympathetic economists warn that without parallel measures to boost supply, a freeze simply defers the reckoning.“If you don’t pair a rent freeze with a credible plan to add housing,” Sims said, “you’re not solving the problem. You’re just pushing off accountability without really solving the underlying problem.”

Car giant JLR has announced a pause in shipments to the United States to tackle "address the new trading terms" imposed by Donald Trump's tariffs. Thursday saw the imposition of a 25% tax on all foreign-made vehicles entering the US, followed by the introduction of a 10% "baseline" tariff on global imports on Saturday morning. JLR, formerly Jaguar Land Rover, is one of many firms worldwide contending with the repercussions of the new trade rules and the resulting market instability. In a statement issued on Saturday, a JLR spokesperson confirmed: "The USA is an important market for JLR's luxury brands. They added, "As we work to address the new trading terms with our business partners, we are taking some short-term actions including a shipment pause in April, as we develop our mid- to longer-term plans." Global trade has been significantly impacted following President Trump's declaration of the tariffs at the White House this past Wednesday. The fallout was significant, with the FTSE 100 enduring its worst trading session since the pandemic began on Friday, and comparable downturns affected Wall Street as well. The FTSE 100 saw all but one stock fall, with Rolls-Royce, the banking sector, and mining companies witnessing substantial losses. Prime Minister Sir Keir Starmer has pledged to “do everything necessary” to protect the UK’s national interest after the tariffs were imposed, saying ministers are “ready to use industrial policy” to support businesses. Writing in the Sunday Telegraph, he said “the immediate priority is to keep calm and fight for the best deal”. He said that in the coming days “we will turbocharge plans that will improve our domestic competitiveness”, and added: “We stand ready to use industrial policy to help shelter British business from the storm.” London's leading stock market index, the FTSE 100, dropped 419.75 points, or 4.95%, to close at 8,054.98 on Friday, marking the largest single-day fall since March 2020 when the index lost more than 600 points in one day. The Dow Jones also took a hit, falling 5.5% on Friday as China matched Mr Trump's tariff rate. Beijing announced it would retaliate with its own 34% tariff on imports of all US products from April 10. Ministers are still striving to secure a deal with the US, hoping that it could provide some exemption from the tariffs. Rachel Reeves stated on Friday that the Government is "determined to get the best deal we can" with Washington.

Barbara Corcoran is renowned for her heart-over-head investment decisions—and for bucking conventional finance wisdom, including proudly not saving a “dime” of her substantial wealth. But she must be doing something right, considering she’s worth about $100 million, and she revealed some keys to her success in real estate.Recommended VideoCorcoran appeared on theBiggerPockets Real Estate Podcastwith her son Tom Higgins to describe two methods she says make up her “golden rule” of real estate investing: putting down 20% on an investment property and having tenants of that property paying for the mortgage.This is the method Corcoran herself used when she borrowed $1,000 from her then-boyfriend to launch her real estate career. After failing at 22 jobs, she said goodbye to her waitressing gig and started a “tiny” real estate office in New York. She ended up selling the Corcoran Group to real estate company NRT for $66 million in 2001, launching her into real estate and business investment stardom. She’s been on the main cast of investors onShark Tanksince its 2009 inception, making deals with more than 100 businesses.The golden rule of real estate investingCorcoran’s method to real estate investing is tried and true.“That has always been my golden rule,” she said. “Buy a property with 20% down. [That] has always been my formula because they used to do with 10%, but it’s not possible anymore. I repeated that formula again and again and again, and then making sure the tenant has paid my mortgage. It’s pretty easy that way.”Putting down 10% instead of 20% can leave a buyer with too high of a monthly payment, a risky move since housing prices and mortgage rates are still elevated. A 20% down payment betters the chance she’ll break even more quickly on a property—and make gains sooner. While that golden rule has worked for Corcoran, other real estate investors warn a one-size-fits-all rule doesn’t always match market conditions.“Each investment protocol is entirely unique and different,” Alex Blackwood, CEO and cofounder of real estate investment platform Mogul Club, toldFortune. “For instance, maybe an investor’s credit score is better so they can take out more with less monthly costs, or maybe interest rates are lower so an investor can increase leverage and still break even.”Breaking even in real estateEven with a strong track record in real estate investing, Corcoran still never expects to make money on her purchases during the first year or two of ownership, she said on the podcast. But breaking even early on—having a tenant cover the mortgage and other monthly costs the owner has—is a good indicator that the investment property will do well. “If I break even, I’m smiling all the way to the bank,” she said. “And then by the second year, third year, New York is a magical place. The value always goes up, and then I start getting a lot of cash. Then I refinance, pull a lot of cash out, refinance, pull cash out. Real estate is magical if done right.”Breaking even in year one helps investors begin profiting in year two, Blackwood agrees. Even though investors may take a short-term hit on a longer-term investment, profitability comes when they can raise the rent, he adds.The “breaking even” golden rule also ties directly to one of real estate’s “underlying principles,” the first of which is leverage, Ian Formigle, former chief investment officer at commercial real estate investing platform CrowdStreet (now a partner at Green Light Development), toldFortune.“Borrowing money to acquire real estate can dramatically amplify the returns to investors, but it can also amplify the risk,” he said. By adhering to Corcoran’s golden rule and getting tenants to cover costs, “you mitigate the leverage risk by generating monthly income through the property. You can also create an opportunity to generate wealth through asset appreciation because well-located real estate can attract more attention and investment over time.”Still, successful real estate investing takes time. During the podcast, Corcoran described a property she bought using her 20% down method, but waited 20 years to sell. She paid $1 million for the property, and sold it for $3.2 million two decades later. Even though this process takes time, Corcoran warns against taking money out of investment properties too soon. “You cripple your business if you start taking money out,” she said. “You want to see how long you can go without touching a dime. That’s what I did.” To make money when she was first getting her start in real estate investing, Corcoran ran her brokerage firm. “I made good money from that,” she added. “But [as for] my buildings, I never looked to it for money until they matured a little bit, and then I started getting a lot of cash out.”A version of this story appeared on Fortune.com on December 5, 2023.More on real estate investing:Buying an investment property: What you should know to get startedNearly 70% of Americans think the economy is on the ‘wrong track’and even more think it’s a bad time to buy a home, Fannie Mae survey showsMillennials and Gen Zers are clamoring to break into the housing market. But this real estate expert says ‘not everyone should be an owner’Did your workplace make our list of the 100 Best Companies to Work For? Explore this year's list.

ShareResizeListen(49 sec)Financial News will be hosting an event for sector leaders as we mark FN Wealth Management’s first birthdayPhoto: Getty ImagesIt will soon be a year sinceFinancial Newsstarted covering wealth management for the first time.Hundreds of you have flocked to our weekly newsletter on the sector. To join them, just click here.You’ll need a subscription to read all of our exclusive news, interviews and in-depth features. To request a free trial, all you have to do is email licensing@efinancialnews.com.To mark our year anniversary, we’ll also be throwing an exclusive event with some of the biggest names in the space. Stay tuned for details.Thanks for your support, and happy reading.

ShareResizeBNP Paribas Wealth Management's boss says buying HSBC's German private bank was 'a very important move', but more deals aren't a priorityPhoto: Antoine DoyenBNP Paribas is taking a hiatus from M&A after scooping up two major businesses for its wealth franchise, according to its chief executive Vincent Lecomte.The French lender inked two mega-deals last year in its investment and protection services division, which spans wealth and asset management.

The American dream of homeownership, long a symbol of stability, achievement, and upward mobility, is facing unprecedented challenges as the median age of the average first-time homebuyer in the United States has soared to 40 years old, according to newly released data from the National Association of Realtors (NAR).Recommended VideoA year ago, the median age was 38 years old, and that’s up from 36 in 2022, 33 in 2020 and 28 in 1991.“It’s kind of a shocking number,” said Jessica Lautz, deputy chief economist and vice president of research at NAR. “And it’s really been in recent years that we’ve seen this steep climb.”This age milestone marks an era where the affordability crisis is fundamentally reshaping the housing landscape and delaying access to the benefits of homeownership for millions of Americans.As ResiClub editor Lance Lambert contextualized it in a statement toFortune, this means the first-time homebuyer in 2025 is “just as close in time to the age when they can begin early Social Security withdrawals (age 62) as they are to their high school graduation (age 18).”The NAR’s 2025 Profile of Home Buyers and Sellers, which surveyed recent home transactions between July 2024 and June 2025, also revealed that first-time buyers now comprise just 21% of all home purchases—a historic low.“The historically low share of first-time buyers underscores the real-world consequences of a housing market starved for affordable inventory,” Lautz said.This steep decline—a contraction of 50% since 2007—has significant ripple effects: not only does it delay or deny wealth accumulation for families, but it also means lost opportunities. NAR estimates a 10-year delay in homeownership could mean losing about $150,000 in equity on a typical starter home over a lifetime.New Barriers for Younger BuyersToday’s first-time homebuyers face arduous financial hurdles. The typical down payment is now 10%, matching the highest level recorded since 1989. Most rely on their personal savings (59%), but a significant contingent is tapping financial assets like 401(k)s and investment accounts (26%), while over one in five are depending on gifts or loans from family or friends (22%). This underscores how entry into homeownership has become less accessible for those without substantial family support or generational wealth.In stark contrast, repeat buyers, whose median age is 62, are better positioned—often wielding equity from previous sales for larger down payments, and 30% can buy homes outright with cash. The result is a bifurcated market, where older, established homeowners find mobility and security, while younger would-be buyers wait longer and risk missing out on key wealth-building years.AsFortunehas reported, this looks like boomers beating millennials in the competition for housing. If you’re 40 years old, you have to compete with someone your parents’ or aunts and uncles’ age for that elusive starter home, in other words.Societal Shifts and Multigenerational TrendsThe NAR profile also shows that only 24% of buyers have children under the age of 18 at home, yet another all-time low. Meanwhile, the share of Americans buying multigenerational homes, where owners care for aging parents and children moving back after college, has dropped to 14% from 17% in 2024.The crisis has brought housing policy to the forefront of the national conversation. Shannon McGahn, NAR executive vice president and chief advocacy officer, stressed the urgent need to address the underlying causes of the affordability crunch, namely the inadequate supply of homes.She called for policies to unlock existing inventory, revitalize underused properties, streamline zoning and permitting barriers, and modernize construction methods to boost affordable, rapid development. Without such action, the dream of homeownership—and the social mobility it promises—may continue to slip further from reach for ordinary Americans.“For generations, access to homeownership has been the primary way Americans build wealth and the cornerstone of the American Dream,” McGahn said.

The impact of Donald Trump's tariffs on Jaguar Land Rover has been brought to light as the luxury car manufacturer detailed its vehicle exports to the US for the first quarter of 2025. The Coventry -based automotive giant reported a 14.4% increase in wholesale volumes in North America during its fourth quarter, as reported by City AM. This information comes following Jaguar Land Rover's announcement over the weekend that it will "pause" shipments to the US while it adjusts to "address the new trading terms" that have arisen as a result of Donald Trump's tariffs. The US administration enforced a 25% tariff on all foreign cars starting Thursday, complemented by a broader "baseline" tariff of 10% on goods imported globally which commenced on Saturday morning. In a statement issued on Saturday, a spokesperson for Jaguar Land Rover commented: "The USA is an important market for Jaguar Land Rover's luxury brands." They added, referencing their response to the tariffs: "As we work to address the new trading terms with our business partners, we are taking some short-term actions including a shipment pause in April, as we develop our mid- to longer-term plans." The details of US wholesale figures come ahead of Jaguar Land Rover releasing a comprehensive set of data before its full-year results for the 12 months up to the end of March 2025, which are expected to be announced in May. In its most recent quarter, the group's wholesale volumes, excluding the Chery Jaguar Land Rover China joint venture, reached 111,413 vehicles. This represents a 6.7% increase compared to the previous three months and a 1.1% rise year on year. When compared to the previous year, wholesale volumes in Europe increased by 10.9%, while in the UK they remained flat at 0.8%. However, the group experienced a significant 29.4% decline in China, and overseas sales fell by 8.1%. Retail sales for the fourth quarter, including the Chery Jaguar Land Rover China joint venture, totalled 108,232 vehicles. This is a decrease of 5.1% compared to the same quarter last year but an increase of 1.8% compared to the preceding three months.

A risky mortgage instrument that helped spark the Global Financial Crisis is on the rise, but three things are different this time around.Recommended VideoAdjustable-rate mortgages (ARMs), once the villain of the subprime meltdown, are surging in popularity as homebuyers look for savings in a high-rate era. The share of ARMs reached nearly 13% of all mortgage applications this fall, per the Mortgage Bankers Association, the highest level since 2008.For buyers today, the lure is clear: ARMs offer starting rates about a full percentage point lower than fixed-rate loans, making the difference between buying a home or staying sidelined. The typical 5/1 ARM has an interest rate in the mid-5% range, compared with the 30-year fixed rate’s 6.3% and above. On a $400,000 loan, that initial discount translates into $200 or more in monthly savings, enough to tip the scales for first-time buyers or those seeking a larger property. But every ARM, by definition, is a wager: After the initial fixed period—often five, seven, or 10 years—the interest rate resets, adjusting with the broader market. Today, that means buyers are betting the Federal Reserve will cut rates before their loan recalculates. If the Fed delivers on anticipated rate drops in December, customers could see payments shrink further or at least avoid big jumps when the adjustment arrives.Back in the mid-2000s, adjustable-rate loans contributed to a financial calamity. Easy credit, teaser introductory rates, and lack of oversight meant millions of Americans took out loans with initially low payments, only to see costs soar when interest rates reset. ARMs then accounted for as much as 35% of mortgage originations, fueling both a housing bubble and the crash that followed. Fast-forward to 2025, and some are justifiably anxious at the product’s resurgence.Borrowers aren’t just gambling with their own fortunes, though. This time, banks and regulators have changed the rules. Today’s ARMs come with strict documentation standards, borrower protections, and built-in caps designed to prevent the shock resets that hammered millions of families in the last crisis. Lenders scrutinize income, debt, and credit quality, and loans are calibrated to ensure that, even if rates go up, buyers won’t be caught entirely off guard. Pre-crisis, some ARMs changed rates almost overnight, but most modern loans fix the initial rate for several years and limit increases through legal ceilings.Risks this time aroundStill, the instrument carries risk—especially if the Federal Reserve changes course. If rates rise unexpectedly, those low initial payments can balloon, exerting pressure on household budgets just as the broader economy absorbs the impact.Unlike the pre-crisis era, buyers are appearing to use ARMs as financial tools for specific strategies, rather than gambling on ever-increasing home values. The trend centers on affordability: With 30-year fixed rates still elevated (averaging near 6.3%), ARMs offer an initial fixed period at rates nearly a full percentage point lower, sometimes saving hundreds per month. And the current vogue appears to reflect an educated guess—or a gamble, depending on your position—that interest rates, and therefore mortgage rates, will continue to decline in the near future.Michael Pearson, senior VP of business development at A&D Mortgage, told Realtor.com earlier this month that “the common wisdom is that interest rates will continue to dip lower, slowly over the next couple of years. So although ARMs offer only short-term fixed interest rates, there may be more opportunities to lock into long-term lower rates in the coming years.” For many, this lower payment is seen as a bridge until rates drop, jobs relocate, or life changes; borrowers are actively planning to refinance, move, or pay off loans before the adjustable period kicks in.In high-cost markets, the pressure to choose ARMs is strong. With fixed mortgage rates remaining stubbornly high after years of Fed rate hikes, buyers are willing to roll the dice on interest rates. Some see ARMs as the only path to homeownership, wagering that central bankers will cut rates as inflation cools off. The harsh reality is that prospective homeowners don’t have much of a choice. A recent Redfin analysis found that America hasn’t been this stuck in terms of housing mobility for at least 30 years, with just roughly 28 out of every 1,000 homes changing hands between January and September. “It’s not healthy for the economy that people are staying put,” said Daryl Fairweather, chief economist at Redfin. The so-called home sales turnover rate through the first nine months of this year is down about 30% from the average rate over the same time periods between 2012 and 2022. Ultimately, the surge in ARM loans is both a sign of tight economic times and renewed risk-taking. While regulatory guardrails may prevent the kind of crash seen in 2008, the outcome for individual borrowers still depends on what the Fed does—and whether buyers truly understand the gamble they’re taking. For now, a controversial loan product is back in the spotlight, and the housing market is holding its breath for the next move from the central bank.For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.

President Donald Trump played down the significance of his proposed 50-year mortgage plan in a recent interview, calling it “not even a big deal… it might help a little bit,” during a segment on Fox News with Laura Ingraham. The idea, which aims to extend mortgage terms for Americans, has triggered a wave of criticism across the political spectrum, as Ingraham noted, with some labeling it a financial trap for homebuyers and a windfall for banks.Recommended VideoIn the interview aired onThe Ingraham Angle, the Fox host pressed Trump on the impact of his housing proposals, including the much-discussed 50-year mortgage concept. Housing costs, Ingraham noted, are pushing the average age of first-time buyers to 40—“sad for the country,” she remarked. Trump defended the policy by saying he “inherited” the predicament and characterized the shift from traditional 30-year to potential 50-year mortgages as minor: “It’s not even a big deal … all it means is you pay less per month, you pay it over a longer period of time. It’s not, like, a big factor. It might help a little bit,” Trump insisted.Trump’s housing director, Bill Pulte, was much more positive on the idea’s impact. “Thanks to President Trump, we are indeed working on The 50-year Mortgage – a complete game changer,” the Federal Housing Finance Agency Director Bill Pulte said Saturday in a statement released on social media.Trump further argued that the more pressing issue was the spike in interest rates, blaming President Biden and Federal Reserve Chair Jerome Powell—whom he referred to as “Too Late”—for sluggish responsiveness. Trump assured viewers that interest rates would come down, but defended the overall strength of the economy under his stewardship: “Even with interest rates up, the economy is the strongest it’s ever been,” he asserted.Ingraham raised the issue of people saying they have significant anxiety about the economy in the electorate, and Trump pushed back. “I don’t know that they are saying that. We’ve got the greatest economy that we’ve ever had.”Ingraham and critics push backThe plan didn’t escape harsh scrutiny, including from Ingraham herself. She pointed out that the backlash wasn’t coming just from Democrats but also from within Trump’s own base, who characterize extended mortgages as giveaways to banks and mortgage lenders. She said Trump’s base was “enraged” and asked him about a “significant MAGA backlash, calling it a giveaway to the banks and simply prolonging the time it would take for Americans to own a home outright. Is that really a good idea?” Ingraham asked.On social media and in public statements, several Republican figures lashed out at the proposal. Rep. Thomas Massie (R-KY) compared the idea to having no real ownership at all, asking, “How is ‘here, enjoy this 50 year mortgage’ different from ‘you will own nothing and you will like it?’” Rep. Marjorie Taylor Greene (R-GA) worried the plan would “ultimately reward the banks, mortgage lenders and homebuilders while people pay far more in interest over time and die before they ever pay off their home. In debt forever, in debt for life!”Conservative media voices echoed these concerns. Glenn Beck described the plan as “almost like… ‘you will own nothing and be happy.'”Bloomberg Opinion’s Allison Schrager, on the other hand, wrote on Tuesday that it’s a good idea, with the market clearly expressing a need for something like the 50-year mortgage to exist. It’s “not a terrible idea,” she wrote, adding that while people who sell their homes before their mortgage matures will get less value, “that may be a worthwhile tradeoff for someone who needs or wants a lower monthly payment.” Still, she added she’s concerned it will be difficult to price and she still has some deep concerns about the idea.

ShareResizePhoto: Timon Schneider/Getty ImagesThis is an online version of Financial News’s wealth management newsletter. To subscribe click hereThis week has felt like the end of an era for several titans of wealth management.

The luxury car giant behind Jaguar and Range Rover says it is confident its business will be “resilient” despite Donald Trump’s new 25% tariffs on automobiles. The US president has imposed a 10% tariff on US imports of UK goods, rising to 25% for cars. Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT), called the news “deeply disappointing and potentially damaging”. The USA is a key market for JLR, formerly Jaguar Land Rover. Last year JLR chose Miami Art Week to launch its Type 00 Jaguar concept vehicle. The car was designed with a theme of “Exuberant Modernism” and the company says it is “a concept with bold forms and exuberant proportions to inspire future Jaguars”. JLR’s North American business is based in Mahwah, New Jersey, and its LinkedIn page says the company “is represented by more than 330 retail outlets”. Analysis this week from the Institute for Public Policy Research (IPPR) showed more than 25,000 direct jobs in the UK car manufacturing industry could be at risk under the new tariff regime as exports fall. And the IPPR said employees at Jaguar Land Rover and Mini were set to be among the most exposed. In a statement, JLR said: “Our luxury brands have global appeal and our business is resilient, accustomed to changing market conditions. Our priorities now are delivering for our clients around the world and addressing these new US trading terms.” In January, JLR posted a pre-tax profit of £523m for the final three months of 2024, down from the £627m reported during the same period in 2023, as reported by City AM. But its pre-tax profit for the 12 months to date stood at £1.6bn, a 7% year-on-year increase. Also in January, JLR said it was investing millions of pounds in new paint facilities at its Castle Bromwich site to help it meet demand for personalised luxury vehicle, where customers pick from hundreds of bespoke paint options across its Range Rover and Range Rover Sport models In September, JLR announced plans for a £500m investment at its Halewood factory in Merseyside to turn it into the “electric vehicle factory of the future”. Mike Hawes from the SMMT said: “The announced imposition of a 10% tariff on all UK products exported to the US, whilst less than other major economies, is another deeply disappointing and potentially damaging measure. “Our cars were already set to attract a punitive 25% tariff overnight and other automotive products are now set to be impacted immediately. “While we hope a deal between the UK and US can still be negotiated, this is yet another challenge to a sector already facing multiple headwinds. “These tariff costs cannot be absorbed by manufacturers, thus hitting US consumers who may face additional costs and a reduced choice of iconic British brands, whilst UK producers may have to review output in the face of constrained demand. 15 stunning pictures of Jaguar's new electric vehicle as Type 00 is launched in Miami “Trade discussions must continue at pace, therefore, and we urge all parties to continue to negotiate and deliver solutions which support jobs, consumer demand and economic growth across both sides of the Atlantic.” Dr Jonathan Owens, operations and supply chain expert at the University of Salford, said: “While the tax on parts might not take effect until May, the new US tariff import policy imposing a global 25% tax on fully assembled and saleable vehicles has already begun. For vehicles already in the supply chain to the US from the UK and other global destinations, automotive manufacturers will probably have to take the hit short-term for the increases as the price negotiations have been completed. “However, if the global US tariff becomes a permanent fixture by the Trump administration, automotive companies will not be able to carry the long-term burden of the increased costs. This will become more noticeable when the tariff tax is expanded to the parts supply chain. The assembly of a vehicle requires parts coming into a centralised manufacturing plant, however there will also be decentralised smaller plants and suppliers offering specialised services. Subsequently, component parts in the assembly may cross multiple borders accumulating tariff costs. So, when the tariff on parts takes place, it will only further increase the cost of the vehicle. “We should also consider this was attempted in Trump’s first presidential office to protect US steel jobs, with a 25% global tariff on imported steel. However, this resulted in a lower job tally of 80,000, compared to the 84,000 it had been in 2018. “Will it last and is the UK right not to retaliate immediately? The US public will not be isolated to these increases due to the supply chains. If US manufacturers are to bring everything in-house, it would take many years and not everything can be sourced within the US. The US citizen could soon find the price of locally made cars increasing and the option to buy cheaper imports has also become too expensive. The situation is far from ideal for a nation who like their cars.”

ShareResizeBarclays private bank and wealth management chief executive Sasha Wiggins says government’s flagship campaign ‘will help make investing an everyday reality for more people’.Barclays’ wealth boss Sasha Wiggins has been selected to chair chancellor Rachel Reeves’ new retail investment campaign.Wiggins, who is chief executive of Barclays’ private bank and wealth management business, will spearhead the government’s flagship initiative, which aims to unlock greater investment in the UK economy.

Flooring manufacturer Airea says investment into its factory capabilities is expected to bring benefits in the third quarter, following strong sales growth but a fall in profits. The carpet tile specialist which owns the Burmatex brand saw 6% sales growth in the second half of 2024, despite a weaker first half in which bosses say announcement of the General Election had brought about cancellations in key public sector work. Full year revenue was up 0.6% to £21.2m and operating profit before valuation gain was down from £1.8m to £700,000, having been impacted by £900,000 worth of costs associated with investment. Airea has been implementing a £5m overhaul of its factory set-up with the introduction of new equipment, including robotics. The work has impacted the AIM-listed firm's bottom line in the short term, but CEO Médéric Payne told BusinessLive he was eager to get the systems running - as commissioning of the equipment could start from June. In full year 2024 results, investors were told of momentum behind the business - and were given a final dividend of 60p per share, up from 55p per share in 2023 and the fourth consecutive year of dividend growth. Airea has said it is well placed for future profitable growth. Asked about markets the firm is looking to grow in, Mr Payne said: "We're doing a bit more in hospitality than we have done traditionally - so that's encouraging. And we're doing a lot more on white label and selling to other manufacturers who want our product but under their brand or credentials. "Some of those are new customers who are wanting to purchase more locally, rather than far away, overseas, and where they've got more control over supply chain. And also, our capabilities are such that we are prepared to do it now." He added: "Bearing in mind, having just done this investment into the factory, and having doubled capacity, we also need to be able to increase - and 'feed the monster' as I say in the office - and to make sure we have enough orders to make sure the investment was worthwhile." In January, post year end, Airea launched a showroom and warehouse operation in Dubai - which Mr Payne said signalled where the business saw growth opportunities. That facility is intended not only as a gateway to Middle East work but also further afield, with the company having identified Dubai as hub to host clients from markets such as Africa. Within the results, chairman Martin Toogood said: "The group was pleased with the positive momentum in the second half of the year. This encouraging performance was delivered despite the ongoing global economic and geopolitical challenges. "We made further progress in expanding our sustainable portfolio with the launch of several carbon-neutral products both in the UK and in our key target overseas markets. The opening of the group's new showroom in Dubai in January 2025 is another example of our investment for future growth. This will operate as a strategic hub to drive sales across the GCC, MEA regions and India.

Sir Keir Starmer has said "all options are on the table" with regard to Scunthorpe steelworks, following Chinese owner Jingye's decision to launch a consultation on its closure. Shuttering of the British Steel plant's blast furnaces could mark the end of virgin steelmaking in the UK which has brought pressure on the Government to act in the face of thousands of job losses. The facility is said to be days away from running out of materials after Jingye initially indicated that closure. Speaking at the Commons Liaison Committee, the Prime Minister said he understood the importance of the plant. He said: "Therefore we will keep talking. We have made an offer, but all options are on the table in relation to Scunthorpe. I think it’s really important and we’re in the middle of those discussions.” Asked what he meant by “all options”, Sir Keir replied: “I don’t want to be unhelpful to the committee, but as you can imagine these are ongoing discussions at the moment. I can reassure the committee that we’re doing everything we can to ensure there is a bright future for Scunthorpe . "But as to precisely where we’ve got to in those talks, I will very happily provide you with further details as soon as I can." Jingye cited high environment costs, the impact of tariffs and a challenging market when it announced the consultation on Scunthorpe. It claimed to have invested more than £1.2bn in British Steel since it took control in 2020, and pointed to £700,000 per day losses. Industry Minister Sarah Jones sought to reassure the steel industry in advance of the first payments from an energy cost relief scheme due to come in next month. The Network Charging Compensation scheme payments are expected to give businesses more than £15m of relief in May and more than £300m during 2025. Ms Jones said: “We know this is a concerning time for our steel industry in the face of global challenges. That’s why we’re working in lockstep with industry to drive forward our steel plan so it can help the sector secure jobs, deliver growth and power the modern economy.

A quaint, 37-home neighborhood an hour from Miami is attracting moneyed residents, including actor Mark Wahlberg, despite not having a private golf club or coastline—instead its major selling point is privacy and a well-trained security staff of former military and police.Recommended VideoStone Creek Ranch, located in Delray Beach, Fla., is one of the hottest new neighborhoods for the ultra rich, but it didn’t always start out that way. The development was first created in the early 2000s a stone’s throw away from the marshy land of the Arthur R. Marshal Loxahatchee National Wildlife Refuge.Senada Adžem, the executive director of luxury sales at Douglas Elliman, said before she started selling homes in the development, prices averaged around $6 million.Adžem broke the mold when she put a house up for sale in the neighborhood for $20 million in 2018. It took her two years to sell it for the first time, but it then sold several times after that. Just last month the same property, now remodeled, sold to Wahlberg for $37 million.The neighborhood’s privacy and security was part of the reason for that sale, as well as the $43 million sale of two properties to Rockstar Energy Drink founder Russell Weiner, who recently changed his legal name to Russ Savage.Most of the houses have 2.5 acre lots, about the size of two football fields, and sit on the edge of an artificial lake, giving each home its own bubble of privacy. There is no golf club so people aren’t coming in and out, said Adžem. Plus, the neighborhood isn’t on the beach, so outsiders can’t peep residents’ backyards from their boats.In addition, the neighborhood includes guarded entrances and 24/7 security made up of armed ex-military and police, which saves residents money.“The clients who can be on the ocean and can afford to pay 100 million-plus for a property will actually have to hire security personnel just for themselves, because, as you know, Florida beaches are public beaches,” said Adžem.Daniel PetroniDaniel PetroniIn a development with such large lots and few houses, it’s possible to build impressive manors. Wahlberg’s new home at 9200 Rockybrook Way, fully remodeled by developer Aldo Stark, spans 18,206 square feet. It sports seven bedrooms and 10 full baths, as well as myriad amenities such as two powder rooms, a home theater, cigar lounge, wine cellar, gym, sauna, guesthouse, and a 170,000 resort-style pool. Stark also included custom agate and onyx pieces that came with the fully furnished home. It also came with a fully stocked fridge for good measure, said Adžem.“This home is a really great value for $37 million—you get a lot of house, you get a lot of property, and of course, you get all of these other things,” Adžem said. “A house like this on the ocean would cost $137 million.”

ShareResizeOutflows for 2025 have reached some £1.4bn, latest results showPhoto: Jose Sarmento Matos/Bloomberg/Getty ImagesAberdeen shed another £500m in the three months to the end of September as the UK fund giant struggles to stem investor redemptions.Net outflows were down 50% from the third quarter in 2024 when clients pulled £1bn from the business, but year-to-date Aberdeen has now seen around £1.4bn walk out the door.

ShareResizeMark Serocold is taking Ares from ‘sleeping giant’ in the European wealth market to a serious player. Illustration: Danilo Agutoli for FNMark Serocold knows what wealthy European investors want. The head of Ares Wealth Management Solutions for Emea, he has been tasked with raising the profile of the $546bn alternatives giant in high net worth hot spots such as the UK, Italy and Switzerland.Ares’ wealth business has amassed $44bn since its inception in 2021 — less than a fifth of rival Blackstone’s $279bn of private wealth assets. However, it has ambitions to manage $100bn globally on behalf of rich individuals by 2028.

ShareResizeSid Azad is the latest senior hire for the UK bank’s wealth pushBarclays has tapped a partner from consulting giant McKinsey to lead its mass affluent business as the UK bank continues its wealth push.Sid Azad has been hired as head of mass affluent and growth and will play a key role in shaping Barclays’ strategy for its private banking and wealth management business in the UK and crown dependencies, the firm said in a statement.

North East defence specialist Pearson Engineering has helped to develop a robot mine sweeper which is now being trialled by the British Army to clear explosives on the front lines. The Newcastle company, based in the famous Armstrong Works, has worked with the Defence Science and Technology Laboratory (Dstl) to create Weevil, a device which is hoped will replace current mine-clearing methods that included Trojan armoured vehicles, which require a three-person team to operate in hazardous areas. The robot mine sweeper is said to be able to clear minefields quicker and safer than present capabilities, reducing risk to soldiers on the front line and it can be operated via remote control by just one person from several miles away. The prototype – which is fitted with a mine plough to clear a safe path – has been successfully tested on a surrogate minefield in Newcastle, and the technology is now being passed to the British Army for further development and more trials. Ian Bell, CEO at Pearson Engineering, said: “We are proud to contribute to such game-changing capability. It brings together decades of development by Pearson Engineering, delivering the very best of minefield breaching technology proven around the world, and contemporary developments in teleoperation. “Work with UK MOD is an incredibly important part of our business, ensuring our troops get the latest in combat engineering capability and that we can effectively defend our nation and allies.” Luke Pollard, minister for the armed forces, said: “It won’t be a moment too soon when we no longer have to send our people directly into harm’s way to clear minefields. “This kit could tackle the deadly threat of mines in the most challenging environments, while being remotely operated by our soldiers several miles away. “It demonstrates British innovation, by British organisations, to protect British troops.” The robot was developed by the Defence Science and Technology Laboratory (DSTL) and Newcastle-based firm Pearson Engineering. The Ministry of Defence said there are no current plans to provide it to Ukraine. DSTL military adviser Major Andrew Maggs said: “Weevil is the perfect combination of tried and tested technology and modern advancements.

ShareResizeThe UK robo-adviser failed to become a household name despite the Wall Street bank's distribution firepowerPhoto: Mike Kemp/Getty ImagesJPMorgan did it. Four years after its landmark deal to acquire Nutmeg, the Wall Street bank has finally shelved the UK digital wealth manager’s brand.Nutmeg will live on. Its existing products and services will be absorbed under JPMorgan Personal Investing, a new retail wealth and investing business that the bank will launch in November.

ShareResizeSt James's Place is enjoying a long-awaited comeback under CEO Mark FitzPatrickPhoto: No CreditSt James’s Place has surpassed £200bn in assets for the first time, as its revamped charging structure was rolled out across the business.Net inflows into the Cirencester-headquartered wealth giant were £1.8bn over the three months to the end of September, according to its latest trading update. This was nearly double the £890m its portfolios attracted over the same period in 2024.

The North East automotive sector is not thought to be in the direct firing line of swingeing tariffs imposed by US president Donald Trump, but it could feel wider secondary impacts. As the lynchpin of the region's cluster, Nissan's Sunderland operation produces cars destined for the UK and European market. However, a number of its neighbouring North East suppliers - including Faltec Europe, Nifco and Kasai UK - make components for other manufacturers, among them prestige brands such as Jaguar Land Rover, which is thought to be more at the mercy of a blanket 25% rate applied to cars built outside of the US. Paul Butler, CEO of the North East Automotive Alliance said: "The blanket 25% tariff on all cars and car parts imported to the US announced by President Trump is disappointing but not surprising. However, these tariffs will not have an adverse effect on the NE automotive sector as Nissan Sunderland do not export to the US and the number of suppliers exporting to the US is minimal – though, due to the global nature of the automotive sector, they will, undoubtedly, impact parent companies of North East operations. "For the wider UK automotive sector it will have an impact, particularly for some of the more iconic brands from the UK. Last year the UK exported over 101,000 cars to the US with a total value of £7.6bn. This makes the US the third biggest market for British built cars behind the EU and UK markets, who account for 70% of all UK manufactured vehicles. The UK and US automotive industries have a long standing and productive relationship, we need to look at how we can work together to drive growth in both markets. "A global trade war and tit-for-tat retaliations, will have an impact on global trade and lead to increased prices for UK consumers. The UK Government’s calm approach whilst seeking a trade deal will, hopefully, minimise any impact for UK consumers." Think tank the Institute of Public Policy and Research has suggested up to 25,000 jobs could be under threat while research from Birmingham University's City-Region Economic Development Institute estimates the automotive tariffs could cost the UK £9.8bn in GDP between now and 2030, and put 137,000 jobs at risk. In an interview on the BBC's Today programme, the Business Secretary, Jonathan Reynolds, admitted the imposition of tariffs will cause worry in the country's automotive sector but said the Government was working in the interests of British Businesses. He said: "There will be people in key sectors like automotive very worried in the UK today and I want them to know - and I want them to be calm and reassured - this is the job of the British Government, we'll keep that work going." Downing Street is in the midst of attempting to negotiate a wider trade deal with Washington. At the same time, Mr Reynolds launched a consultation with businesses on the implications of potential retaliatory efforts - a move he said was necessary to "keep all actions on the table". The Society of Motor Manufacturers and Traders (SMMT) - the key automotive voice in the country - echoed disappointment about the "punitive" tariffs and said it was yet another challenge for the sector which was already facing several headwinds. But said it hopes the UK and US could still negotiate a deal.

An electronics manufacturer has warned that US tariffs could impact its ability to keep operating. TTE Electronics has bases in Asia, North America and five sites around the UK alongside its Woking headquarters, including a facility in Bedlington specialising in R&D and semiconductors. New results show strong performance in Europe and the UK was offset by slumping demand in the US. Overall, it chalked up £521.1m in revenues, down from £613.9m. The previous year’s operating profit of £3m was converted to a loss of £23.5m. The Stock Exchange-listed business, which engineers and manufactures products to support sectors from healthcare to aerospace, posted a pre-tax loss of £33.4m for 2024, and said the import taxes and retaliatory measures had led to an “uncertain and volatile” backdrop. In the UK, the firm has nine bases including sites in Abercynon, Bedlington, Fairford, Eastleigh, Nottingham, Sheffield, Manchester, and Barnstaple, having divested its sites in Hartlepool and Cardiff during the year. Its Bedlington base, founded in 1937, has 414 employees helping to produce microelectronics and resistors used by global manufacturers in the aerospace and defence markets. It has previously warned of difficulty in its US branch, with falling demand for the components it produces and ongoing production issues at its factories, which have led to it booking a £52.2m write-down. The first half of the year also saw 500 redundancies in its North America operations, which it expects to result in £12m of annual cost savings. Bosses warned that the recent US global tariffs, leading to retaliatory charges from some countries including China, had led to an “uncertain and volatile macroeconomic backdrop which could have an impact beyond that assumed in the severe downside case”. That means conditions could worsen beyond its worst-case scenario, particularly if US customers cut back on orders, which could impact its ability to keep operating and being profitable in the year ahead. It said: “The board is mindful of the increased market uncertainty arising from the recently announced trade tariffs and the potential impact on demand patterns. The recent introduction of US global tariffs and certain retaliatory tariffs provide an uncertain and volatile macroeconomic backdrop which could have an impact beyond that assumed in the severe downside case. "This has led the board to conclude that it is not possible to be certain of meeting the covenant test in certain extreme scenarios, in particular where customer reticence in placing orders against the backdrop of tariff uncertainty reduces order intake. These matters represent a material uncertainty which may cast doubt upon the group’s ability and the company’s ability to continue as a going concern for the period up to 30 June 2026.” It also now expects to report adjusted operating profit of between £32m and £40m for the year ahead, down from the £40m to £46m previously forecast. TT Electronics also announced its chief executive Peter France was stepping down “with immediate effect” and has been replaced by finance chief Eric Lakin on an interim basis. It also announced it is “assessing all options” for its struggling components division. Despite the warning, it said contract awards and growth drivers within the UK and Europe are “giving us confidence as we look forward”, with highlights including a two-year contract secured by the Bedlington team from a medical device innovator for the production of high voltage chip resistors.

For Ziad El Chaar, CEO of luxury developer DarGlobal, the future of the luxury industry isn’t measured purely in financial returns—it’s about emotional capital. While ROI is a return on investment, he said at the Fortune Global Forum in Riyadh on Monday, “In the luxury segment, we always say we’re giving you a lot of ROE: A return on ego.”Recommended VideoThat “return on ego,” Chaar explained, is what drives buyers toward exclusivity and identity-defining purchases. Whether it’s a limited-edition watch, a supercar, or what he calls the “limited edition of real estate”—co-branded luxury developments that partner with prestige brands including Aston Martin, for example—today’s affluent consumers are chasing rarity and recognition as much as yield. “We first identify demand before we build,” he said. In the Gulf, this demand has manifested as aspirational and rare goods, which DarGlobal’s co-branded product aims to deliver.More broadly, the global luxury market has evolved rapidly since 2020, rebounding from the pandemic to reach an estimated $327.52 billion in 2024 and projected to reach $480.54 billion by 2033, according to Straits Research. But aside from luxury goods, consumers are more often seeking out luxury experiences, a 2025 study by McKinsey found. The desire for a more luxury lifestyle connects directly to the success of high-end real estate development in the Middle East. While Europe remains an anchor, the center of gravity has shifted east—and increasingly, south. Gateway cities in the Middle East, Chaar argued, are now commanding global attention. “In the Gulf, we have almost the perfect formula,” he said. “Infrastructure, governance, lifestyle, safety, and speed. This region is ready to be treated as one ecosystem of gateway cities—from Riyadh to Jeddah to Dubai to Abu Dhabi to Doha.”Dubai already ranks among the world’s leading wealth hubs, attracting nearly 10,000 new millionaires in 2025 alone. Saudi Arabia is experiencing its own boom and is projected to attract 2,400 high-net-worth individuals in 2025, an 800% increase from 2024. The Kingdom’s real estate market is also flourishing, generating $132.3 billion in 2024 and is predicted to reach $201.4 billion by 2030. This growth has been bolstered by Vision 2030 reforms that will allow freehold ownership for foreigners starting in 2026. DarGlobal, which has invested 20 billion riyals (~$5.3 billion USD) to find foreign buyers, has already sold to investors from 40 nationalities in Riyadh and Jeddah projects—before the law even takes effect.Chaar’s company has positioned itself at the heart of this transformation. Its Saudi portfolio includes the Trump Tower and Trump Plaza in Jeddah and the Mouawad-designed Neptune villas in Riyadh, blending global brand recognition with local ambition. He believes these developments do more than house the wealthy—they anchor cities culturally and economically. “It’s very important when we think about these communities, you’re not going to go and build a remote community and build walls around it. You have to put it in a place where it serves as an anchor, because a luxury community in a city serves as an anchor for the city, as the image of the city,” he said, pointing to the development of Diriyah Gate in Riyadh. The development project, he explained, serves the wealthy and ultra-wealthy. “At the same time, it’s inclusive. It also has a lot of developments around it for the people who are going to work in that project. And it has the entertainment aspect, the retail aspect and the cultural aspect,” Chaar added.As the global luxury market tilts toward experience, identity, and geographic diversification, Chaar sees the Gulf as its next epicenter. The GCC’s economy is slightly larger than that of Italy (around $3.5 trillion), but he notes the region has an edge and extremely high potential in terms of its dynamism, infrastructure development, lifestyle, and stability. “Just like Italy has at least 10 destination cities, we deserve in the Gulf to be looked at as one region with at least 10 top destinations,” he said.

ShareResizeUBS has overhauled its wealth management business to turbocharge growth two years after its shotgun wedding with rival Credit SuissePhoto: Bloomberg via Getty ImagesThis is an online version of FN’s weekly wealth management newsletter. To subscribe, click here“We bank the world’s billionaires. That is our brand… but I want to add more advisers catering to high net worth and core affluent.”

A packaging firm that makes plastic films for supermarkets and the food industry has been bought from its administrators by Manchester’s Coral Products, saving 55 jobs. Plastic and packaging specialist Coral, of Wythenshawe, has agreed to buy the business and assets of Arrow Film Converters from its administrators for £502,899 in cash, through its wholly owned subsidiary Film & Foil Solutions. Coral said it had made an initial cash payment of £202,899, with the outstanding balance to be settled within 14 days following completion. The group said: “The cash payments have been funded without any increase to existing group facilities". Coral’s Film & Foil arm has also agreed to a six-month licence to occupy Arrow’s facility in Castleford, West Yorkshire, as it negotiates a long-term agreement. It has also taken on Arrow’s 55 staff and plans to run the business as a going concern, and has also acquired Arrow’s assets including flexographic printing machines, laminators, and slitting and punching facilities. Arrow is an approved supplier to UK supermarkets. It reported sales of £12.5m in the year to January 2022, £17.9m in the 18 months to July 2023 and current sales demand of around £1m per month. Joe Grimmond, Coral’s non-executive chairman, said "This acquisition propels Film & Foil into the front line of specialist flexible packaging and provides Coral Products plc with capacity toward its medium-term goal of £50 million of production availability."

The White House says it is considering backing a 50-year mortgage to help alleviate the home affordability crisis in the country. But the announcement drew immediate criticism from policymakers, social media and economists, who said a 50-year mortgage would do little to resolve other core problems in the housing market, such as a lack of supply and high interest rates.Recommended VideoBill Pulte, director of the Federal Housing Finance Agency, said on X over the weekend that a 50-year mortgage would be “a complete game changer” for homebuyers. FHFA is the part of the federal government that oversees Fannie Mae and Freddie Mac, which buy and insure the vast majority of mortgages in the country.The 30-year mortgage is a uniquely American financial product and the default way to buy a home since the New Deal. Politicians and policymakers at the time wanted to create a standardized mortgage that borrowers could afford and pay off during their working years, when the average lifespan for an American was 66 years old.Lower paymentExtending the life of a mortgage to 50 years does decrease a borrower’s monthly payment.The average selling price of a home in the U.S. was $415,200 in September, according to National Association of Realtors. Assuming a standard 10% down payment and an average interest rate of 6.17%, the monthly payment on a 30-year mortgage would be $2,288 while the payment on a 50-year mortgage would be $2,022. That’s presuming a bank would not require a higher interest rate on a 50-year mortgage, due to the longer duration of the loan.But significantly higher interestBecause even more of the monthly payment on a 50-year mortgage would go toward interest on the loan, it would take 30 years before a borrower would accumulate $100,000 in equity, not including home price appreciation and the down payment. That’s compared to 12-13 years to accumulate $100,000 in equity when paying off a 30-year mortgage, excluding the down payment.A borrower would pay, roughly, an additional $389,000 in interest over the life of a 50-year mortgage compared to a 30-year mortgage, according to an AP analysis.Other analysts came to a similar conclusion.“Extending a mortgage from 30 years to 50 years could double the (dollar) amount of interest paid by the homebuyer on a median priced home over the life of the loan and significantly slow equity accumulation,” wrote John Lovallo with UBS Securities.Broader housing issuesA 50-year mortgage does nothing to solve one critical issue when it comes to housing affordability — the lack of supply of homes. States like California and cities like New York have recently passed legislation or made regulatory changes to allow builders to build homes faster with less regulatory red tape.There’s also the raw cost of homebuilding in the country. Products such as steel, lumber, concrete, copper and plastics that go into home construction are now subject to tariffs under President Trump. Further, many construction jobs were being done by undocumented workers, particularly in the Southwest, where deportations are impacting the ability for homebuilders to find enough labor to build homes.“Many of the big things that would address supply right now are going in the wrong direction,” said Mike Konczal, senior director of policy and research at the Economic Security Project.”Pulte said on X that the introduction of a 50-year mortgage was just a “potential weapon,” among other solutions the White House has considered to combat high housing prices.Americans don’t live long enoughThe average age of a first-time homebuyer has been creeping up for years and is now roughly 40 years of age. A 50-year mortgage would be difficult to underwrite for a bank for a 40-year-old first-time homebuyer, who would be 90 years old by the time that home is paid off. The average life expectancy of an American is now roughly 79 years, meaning there’s 11 years of life expectancy not covered in a 50-year loan.“It’s typically not a goal of policymakers to pass on mortgage debt to a borrowers’ children,” Konczal said.Others have tried longer loansOther parts of the financial system have extended loan terms, to mixed results. The seven-year auto loan has become increasingly common as car prices have risen and Americans keep their cars longer. Despite longer loan terms, auto loan delinquencies have been rising, and the average price of a new car is now $49,740 compared to a price of $38,948 for a new vehicle five years ago.Student loans were originally designed to be paid off in 10 years, and now there are multiple payment options that extend repayment out to 20 years.Economists pointed out that a 50-year mortgage may do the opposite of helping with home affordability by causing home price inflation by introducing more potential buyers into a market struggling with supply.Trump downplays ideaAfter significant criticism, President Trump seemed less enthused about the 50-year mortgage. When asked by Laura Ingraham of Fox News about the idea, President Trump said it “might help a little bit” but seemed to brush it off.Under the Dodd-Frank Act, the mortgage giants Fannie Mae and Freddie Mac cannot insure a mortgage that is longer than 30 years, so any 50-year mortgage would be considered a “non-qualifying mortgage” and would be more difficult to sell to investors. Congress would have to amend U.S. financial laws in multiple places to allow for 50-year mortgages, and there seems to be little appetite for Congress to take this on immediately.

ShareResizeOne of the UK’s first robo-advisers will see its moniker disappear four years after a takeover by the Wall Street giantPhoto: Pavlo Gonchar/Getty ImagesJPMorgan is axing the Nutmeg brand in the UK four years after its landmark takeover of the digital wealth manager.JPMorgan Personal Investing will go live from November, according to a statement from the firm, with a range of managed investments, pensions and ISAs.

ShareResizeUBS wealth assets grew to $4.7tn globally at the end of September following strong flows during Q3Photo: Alamy Stock PhotoUBS’s global wealth business gathered $38bn in new money during the third quarter, despite a spike in client redemptions in the US.The Zurich-headquartered firm’s ultra wealthy clients poured $37.5bn into the business in the three months to the end of September, up 50% compared with the same period in 2024.