Production volumes and turnover have jumped at Nissan's Sunderland factory, but a reorganisation of the business has seen it take on more costs. New accounts for Nissan Motor Manufacturing (UK) Limited show 325,000 cars rolled off the production line at the Wearside plant in 2024, compared with 260,000 the year before. Clearing disruption from worldwide semiconductor chip shortages over recent years was said to have helped the factory ramp up numbers with the Qashqai remaining the brand's biggest seller and one of the UK's top 10 models, of which 199,000 left for UK and European showrooms. Turnover was boosted from £5.03bn to £7.35bn in the year to the end of March 2024, as cost of sales crept up from £4.67bn to £6.92bn. But the plant swung to a loss during the year - recording an operating loss of £41.2m, from an operating profit of £49.4m a year earlier. Bosses said the losses had partly been caused by provisions for supplier claims amounting to £214m - including costs associated with onsite supplier activity and where there had been unforeseen changes to production schedules, along with price inflation. An internal shake-up of how Nissan is organised has also given the Sunderland plant a new status within the global group, making it liable for vehicle warranty costs where defects may have cropped up in the first three years or 100,000km of the vehicles it makes. The changes are said to have given the company more importance and prominence within the Japanese group. Staffing levels also increased during the year - with headcount reaching nearly 7,000. That was said to have been driven by the increased production volumes and additional design staff needed for future electric vehicle projects. The Sunderland plant is preparing to start making the third generation Leaf later this year, with new look Juke and Qashqai models revealed during last year. In recent weeks, Nissan issued images of a trio of models - including the third generation Leaf, as well as an all-electric Juke and the return of the Micra - which it hopes will do well in the European market. Results for Nissan's Sunderland operation, which has been there since the mid 1980s, are set against a challenging time for the Japanese multinational, which has been facing falling sales, financial challenges and a botched merger attempt with rivals Honda. Those difficulties have prompted a major restructuring of the business including slashing production and plans to shut three plants, including one in Thailand and two, as yet, unidentified.

Car giant JLR has announced a pause in shipments to the United States to tackle "address the new trading terms" imposed by Donald Trump's tariffs. Thursday saw the imposition of a 25% tax on all foreign-made vehicles entering the US, followed by the introduction of a 10% "baseline" tariff on global imports on Saturday morning. JLR, formerly Jaguar Land Rover, is one of many firms worldwide contending with the repercussions of the new trade rules and the resulting market instability. In a statement issued on Saturday, a JLR spokesperson confirmed: "The USA is an important market for JLR's luxury brands. They added, "As we work to address the new trading terms with our business partners, we are taking some short-term actions including a shipment pause in April, as we develop our mid- to longer-term plans." Global trade has been significantly impacted following President Trump's declaration of the tariffs at the White House this past Wednesday. The fallout was significant, with the FTSE 100 enduring its worst trading session since the pandemic began on Friday, and comparable downturns affected Wall Street as well. The FTSE 100 saw all but one stock fall, with Rolls-Royce, the banking sector, and mining companies witnessing substantial losses. Prime Minister Sir Keir Starmer has pledged to “do everything necessary” to protect the UK’s national interest after the tariffs were imposed, saying ministers are “ready to use industrial policy” to support businesses. Writing in the Sunday Telegraph, he said “the immediate priority is to keep calm and fight for the best deal”. He said that in the coming days “we will turbocharge plans that will improve our domestic competitiveness”, and added: “We stand ready to use industrial policy to help shelter British business from the storm.” London's leading stock market index, the FTSE 100, dropped 419.75 points, or 4.95%, to close at 8,054.98 on Friday, marking the largest single-day fall since March 2020 when the index lost more than 600 points in one day. The Dow Jones also took a hit, falling 5.5% on Friday as China matched Mr Trump's tariff rate. Beijing announced it would retaliate with its own 34% tariff on imports of all US products from April 10. Ministers are still striving to secure a deal with the US, hoping that it could provide some exemption from the tariffs. Rachel Reeves stated on Friday that the Government is "determined to get the best deal we can" with Washington.

The impact of Donald Trump's tariffs on Jaguar Land Rover has been brought to light as the luxury car manufacturer detailed its vehicle exports to the US for the first quarter of 2025. The Coventry -based automotive giant reported a 14.4% increase in wholesale volumes in North America during its fourth quarter, as reported by City AM. This information comes following Jaguar Land Rover's announcement over the weekend that it will "pause" shipments to the US while it adjusts to "address the new trading terms" that have arisen as a result of Donald Trump's tariffs. The US administration enforced a 25% tariff on all foreign cars starting Thursday, complemented by a broader "baseline" tariff of 10% on goods imported globally which commenced on Saturday morning. In a statement issued on Saturday, a spokesperson for Jaguar Land Rover commented: "The USA is an important market for Jaguar Land Rover's luxury brands." They added, referencing their response to the tariffs: "As we work to address the new trading terms with our business partners, we are taking some short-term actions including a shipment pause in April, as we develop our mid- to longer-term plans." The details of US wholesale figures come ahead of Jaguar Land Rover releasing a comprehensive set of data before its full-year results for the 12 months up to the end of March 2025, which are expected to be announced in May. In its most recent quarter, the group's wholesale volumes, excluding the Chery Jaguar Land Rover China joint venture, reached 111,413 vehicles. This represents a 6.7% increase compared to the previous three months and a 1.1% rise year on year. When compared to the previous year, wholesale volumes in Europe increased by 10.9%, while in the UK they remained flat at 0.8%. However, the group experienced a significant 29.4% decline in China, and overseas sales fell by 8.1%. Retail sales for the fourth quarter, including the Chery Jaguar Land Rover China joint venture, totalled 108,232 vehicles. This is a decrease of 5.1% compared to the same quarter last year but an increase of 1.8% compared to the preceding three months.

The luxury car giant behind Jaguar and Range Rover says it is confident its business will be “resilient” despite Donald Trump’s new 25% tariffs on automobiles. The US president has imposed a 10% tariff on US imports of UK goods, rising to 25% for cars. Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT), called the news “deeply disappointing and potentially damaging”. The USA is a key market for JLR, formerly Jaguar Land Rover. Last year JLR chose Miami Art Week to launch its Type 00 Jaguar concept vehicle. The car was designed with a theme of “Exuberant Modernism” and the company says it is “a concept with bold forms and exuberant proportions to inspire future Jaguars”. JLR’s North American business is based in Mahwah, New Jersey, and its LinkedIn page says the company “is represented by more than 330 retail outlets”. Analysis this week from the Institute for Public Policy Research (IPPR) showed more than 25,000 direct jobs in the UK car manufacturing industry could be at risk under the new tariff regime as exports fall. And the IPPR said employees at Jaguar Land Rover and Mini were set to be among the most exposed. In a statement, JLR said: “Our luxury brands have global appeal and our business is resilient, accustomed to changing market conditions. Our priorities now are delivering for our clients around the world and addressing these new US trading terms.” In January, JLR posted a pre-tax profit of £523m for the final three months of 2024, down from the £627m reported during the same period in 2023, as reported by City AM. But its pre-tax profit for the 12 months to date stood at £1.6bn, a 7% year-on-year increase. Also in January, JLR said it was investing millions of pounds in new paint facilities at its Castle Bromwich site to help it meet demand for personalised luxury vehicle, where customers pick from hundreds of bespoke paint options across its Range Rover and Range Rover Sport models In September, JLR announced plans for a £500m investment at its Halewood factory in Merseyside to turn it into the “electric vehicle factory of the future”. Mike Hawes from the SMMT said: “The announced imposition of a 10% tariff on all UK products exported to the US, whilst less than other major economies, is another deeply disappointing and potentially damaging measure. “Our cars were already set to attract a punitive 25% tariff overnight and other automotive products are now set to be impacted immediately. “While we hope a deal between the UK and US can still be negotiated, this is yet another challenge to a sector already facing multiple headwinds. “These tariff costs cannot be absorbed by manufacturers, thus hitting US consumers who may face additional costs and a reduced choice of iconic British brands, whilst UK producers may have to review output in the face of constrained demand. 15 stunning pictures of Jaguar's new electric vehicle as Type 00 is launched in Miami “Trade discussions must continue at pace, therefore, and we urge all parties to continue to negotiate and deliver solutions which support jobs, consumer demand and economic growth across both sides of the Atlantic.” Dr Jonathan Owens, operations and supply chain expert at the University of Salford, said: “While the tax on parts might not take effect until May, the new US tariff import policy imposing a global 25% tax on fully assembled and saleable vehicles has already begun. For vehicles already in the supply chain to the US from the UK and other global destinations, automotive manufacturers will probably have to take the hit short-term for the increases as the price negotiations have been completed. “However, if the global US tariff becomes a permanent fixture by the Trump administration, automotive companies will not be able to carry the long-term burden of the increased costs. This will become more noticeable when the tariff tax is expanded to the parts supply chain. The assembly of a vehicle requires parts coming into a centralised manufacturing plant, however there will also be decentralised smaller plants and suppliers offering specialised services. Subsequently, component parts in the assembly may cross multiple borders accumulating tariff costs. So, when the tariff on parts takes place, it will only further increase the cost of the vehicle. “We should also consider this was attempted in Trump’s first presidential office to protect US steel jobs, with a 25% global tariff on imported steel. However, this resulted in a lower job tally of 80,000, compared to the 84,000 it had been in 2018. “Will it last and is the UK right not to retaliate immediately? The US public will not be isolated to these increases due to the supply chains. If US manufacturers are to bring everything in-house, it would take many years and not everything can be sourced within the US. The US citizen could soon find the price of locally made cars increasing and the option to buy cheaper imports has also become too expensive. The situation is far from ideal for a nation who like their cars.”

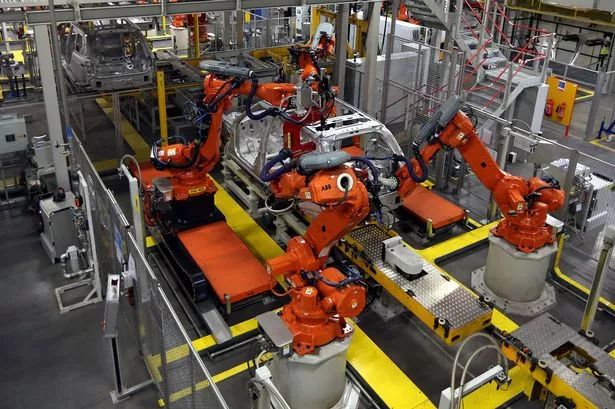

Flooring manufacturer Airea says investment into its factory capabilities is expected to bring benefits in the third quarter, following strong sales growth but a fall in profits. The carpet tile specialist which owns the Burmatex brand saw 6% sales growth in the second half of 2024, despite a weaker first half in which bosses say announcement of the General Election had brought about cancellations in key public sector work. Full year revenue was up 0.6% to £21.2m and operating profit before valuation gain was down from £1.8m to £700,000, having been impacted by £900,000 worth of costs associated with investment. Airea has been implementing a £5m overhaul of its factory set-up with the introduction of new equipment, including robotics. The work has impacted the AIM-listed firm's bottom line in the short term, but CEO Médéric Payne told BusinessLive he was eager to get the systems running - as commissioning of the equipment could start from June. In full year 2024 results, investors were told of momentum behind the business - and were given a final dividend of 60p per share, up from 55p per share in 2023 and the fourth consecutive year of dividend growth. Airea has said it is well placed for future profitable growth. Asked about markets the firm is looking to grow in, Mr Payne said: "We're doing a bit more in hospitality than we have done traditionally - so that's encouraging. And we're doing a lot more on white label and selling to other manufacturers who want our product but under their brand or credentials. "Some of those are new customers who are wanting to purchase more locally, rather than far away, overseas, and where they've got more control over supply chain. And also, our capabilities are such that we are prepared to do it now." He added: "Bearing in mind, having just done this investment into the factory, and having doubled capacity, we also need to be able to increase - and 'feed the monster' as I say in the office - and to make sure we have enough orders to make sure the investment was worthwhile." In January, post year end, Airea launched a showroom and warehouse operation in Dubai - which Mr Payne said signalled where the business saw growth opportunities. That facility is intended not only as a gateway to Middle East work but also further afield, with the company having identified Dubai as hub to host clients from markets such as Africa. Within the results, chairman Martin Toogood said: "The group was pleased with the positive momentum in the second half of the year. This encouraging performance was delivered despite the ongoing global economic and geopolitical challenges. "We made further progress in expanding our sustainable portfolio with the launch of several carbon-neutral products both in the UK and in our key target overseas markets. The opening of the group's new showroom in Dubai in January 2025 is another example of our investment for future growth. This will operate as a strategic hub to drive sales across the GCC, MEA regions and India.

Sir Keir Starmer has said "all options are on the table" with regard to Scunthorpe steelworks, following Chinese owner Jingye's decision to launch a consultation on its closure. Shuttering of the British Steel plant's blast furnaces could mark the end of virgin steelmaking in the UK which has brought pressure on the Government to act in the face of thousands of job losses. The facility is said to be days away from running out of materials after Jingye initially indicated that closure. Speaking at the Commons Liaison Committee, the Prime Minister said he understood the importance of the plant. He said: "Therefore we will keep talking. We have made an offer, but all options are on the table in relation to Scunthorpe. I think it’s really important and we’re in the middle of those discussions.” Asked what he meant by “all options”, Sir Keir replied: “I don’t want to be unhelpful to the committee, but as you can imagine these are ongoing discussions at the moment. I can reassure the committee that we’re doing everything we can to ensure there is a bright future for Scunthorpe . "But as to precisely where we’ve got to in those talks, I will very happily provide you with further details as soon as I can." Jingye cited high environment costs, the impact of tariffs and a challenging market when it announced the consultation on Scunthorpe. It claimed to have invested more than £1.2bn in British Steel since it took control in 2020, and pointed to £700,000 per day losses. Industry Minister Sarah Jones sought to reassure the steel industry in advance of the first payments from an energy cost relief scheme due to come in next month. The Network Charging Compensation scheme payments are expected to give businesses more than £15m of relief in May and more than £300m during 2025. Ms Jones said: “We know this is a concerning time for our steel industry in the face of global challenges. That’s why we’re working in lockstep with industry to drive forward our steel plan so it can help the sector secure jobs, deliver growth and power the modern economy.

North East defence specialist Pearson Engineering has helped to develop a robot mine sweeper which is now being trialled by the British Army to clear explosives on the front lines. The Newcastle company, based in the famous Armstrong Works, has worked with the Defence Science and Technology Laboratory (Dstl) to create Weevil, a device which is hoped will replace current mine-clearing methods that included Trojan armoured vehicles, which require a three-person team to operate in hazardous areas. The robot mine sweeper is said to be able to clear minefields quicker and safer than present capabilities, reducing risk to soldiers on the front line and it can be operated via remote control by just one person from several miles away. The prototype – which is fitted with a mine plough to clear a safe path – has been successfully tested on a surrogate minefield in Newcastle, and the technology is now being passed to the British Army for further development and more trials. Ian Bell, CEO at Pearson Engineering, said: “We are proud to contribute to such game-changing capability. It brings together decades of development by Pearson Engineering, delivering the very best of minefield breaching technology proven around the world, and contemporary developments in teleoperation. “Work with UK MOD is an incredibly important part of our business, ensuring our troops get the latest in combat engineering capability and that we can effectively defend our nation and allies.” Luke Pollard, minister for the armed forces, said: “It won’t be a moment too soon when we no longer have to send our people directly into harm’s way to clear minefields. “This kit could tackle the deadly threat of mines in the most challenging environments, while being remotely operated by our soldiers several miles away. “It demonstrates British innovation, by British organisations, to protect British troops.” The robot was developed by the Defence Science and Technology Laboratory (DSTL) and Newcastle-based firm Pearson Engineering. The Ministry of Defence said there are no current plans to provide it to Ukraine. DSTL military adviser Major Andrew Maggs said: “Weevil is the perfect combination of tried and tested technology and modern advancements.

The North East automotive sector is not thought to be in the direct firing line of swingeing tariffs imposed by US president Donald Trump, but it could feel wider secondary impacts. As the lynchpin of the region's cluster, Nissan's Sunderland operation produces cars destined for the UK and European market. However, a number of its neighbouring North East suppliers - including Faltec Europe, Nifco and Kasai UK - make components for other manufacturers, among them prestige brands such as Jaguar Land Rover, which is thought to be more at the mercy of a blanket 25% rate applied to cars built outside of the US. Paul Butler, CEO of the North East Automotive Alliance said: "The blanket 25% tariff on all cars and car parts imported to the US announced by President Trump is disappointing but not surprising. However, these tariffs will not have an adverse effect on the NE automotive sector as Nissan Sunderland do not export to the US and the number of suppliers exporting to the US is minimal – though, due to the global nature of the automotive sector, they will, undoubtedly, impact parent companies of North East operations. "For the wider UK automotive sector it will have an impact, particularly for some of the more iconic brands from the UK. Last year the UK exported over 101,000 cars to the US with a total value of £7.6bn. This makes the US the third biggest market for British built cars behind the EU and UK markets, who account for 70% of all UK manufactured vehicles. The UK and US automotive industries have a long standing and productive relationship, we need to look at how we can work together to drive growth in both markets. "A global trade war and tit-for-tat retaliations, will have an impact on global trade and lead to increased prices for UK consumers. The UK Government’s calm approach whilst seeking a trade deal will, hopefully, minimise any impact for UK consumers." Think tank the Institute of Public Policy and Research has suggested up to 25,000 jobs could be under threat while research from Birmingham University's City-Region Economic Development Institute estimates the automotive tariffs could cost the UK £9.8bn in GDP between now and 2030, and put 137,000 jobs at risk. In an interview on the BBC's Today programme, the Business Secretary, Jonathan Reynolds, admitted the imposition of tariffs will cause worry in the country's automotive sector but said the Government was working in the interests of British Businesses. He said: "There will be people in key sectors like automotive very worried in the UK today and I want them to know - and I want them to be calm and reassured - this is the job of the British Government, we'll keep that work going." Downing Street is in the midst of attempting to negotiate a wider trade deal with Washington. At the same time, Mr Reynolds launched a consultation with businesses on the implications of potential retaliatory efforts - a move he said was necessary to "keep all actions on the table". The Society of Motor Manufacturers and Traders (SMMT) - the key automotive voice in the country - echoed disappointment about the "punitive" tariffs and said it was yet another challenge for the sector which was already facing several headwinds. But said it hopes the UK and US could still negotiate a deal.

An electronics manufacturer has warned that US tariffs could impact its ability to keep operating. TTE Electronics has bases in Asia, North America and five sites around the UK alongside its Woking headquarters, including a facility in Bedlington specialising in R&D and semiconductors. New results show strong performance in Europe and the UK was offset by slumping demand in the US. Overall, it chalked up £521.1m in revenues, down from £613.9m. The previous year’s operating profit of £3m was converted to a loss of £23.5m. The Stock Exchange-listed business, which engineers and manufactures products to support sectors from healthcare to aerospace, posted a pre-tax loss of £33.4m for 2024, and said the import taxes and retaliatory measures had led to an “uncertain and volatile” backdrop. In the UK, the firm has nine bases including sites in Abercynon, Bedlington, Fairford, Eastleigh, Nottingham, Sheffield, Manchester, and Barnstaple, having divested its sites in Hartlepool and Cardiff during the year. Its Bedlington base, founded in 1937, has 414 employees helping to produce microelectronics and resistors used by global manufacturers in the aerospace and defence markets. It has previously warned of difficulty in its US branch, with falling demand for the components it produces and ongoing production issues at its factories, which have led to it booking a £52.2m write-down. The first half of the year also saw 500 redundancies in its North America operations, which it expects to result in £12m of annual cost savings. Bosses warned that the recent US global tariffs, leading to retaliatory charges from some countries including China, had led to an “uncertain and volatile macroeconomic backdrop which could have an impact beyond that assumed in the severe downside case”. That means conditions could worsen beyond its worst-case scenario, particularly if US customers cut back on orders, which could impact its ability to keep operating and being profitable in the year ahead. It said: “The board is mindful of the increased market uncertainty arising from the recently announced trade tariffs and the potential impact on demand patterns. The recent introduction of US global tariffs and certain retaliatory tariffs provide an uncertain and volatile macroeconomic backdrop which could have an impact beyond that assumed in the severe downside case. "This has led the board to conclude that it is not possible to be certain of meeting the covenant test in certain extreme scenarios, in particular where customer reticence in placing orders against the backdrop of tariff uncertainty reduces order intake. These matters represent a material uncertainty which may cast doubt upon the group’s ability and the company’s ability to continue as a going concern for the period up to 30 June 2026.” It also now expects to report adjusted operating profit of between £32m and £40m for the year ahead, down from the £40m to £46m previously forecast. TT Electronics also announced its chief executive Peter France was stepping down “with immediate effect” and has been replaced by finance chief Eric Lakin on an interim basis. It also announced it is “assessing all options” for its struggling components division. Despite the warning, it said contract awards and growth drivers within the UK and Europe are “giving us confidence as we look forward”, with highlights including a two-year contract secured by the Bedlington team from a medical device innovator for the production of high voltage chip resistors.

A packaging firm that makes plastic films for supermarkets and the food industry has been bought from its administrators by Manchester’s Coral Products, saving 55 jobs. Plastic and packaging specialist Coral, of Wythenshawe, has agreed to buy the business and assets of Arrow Film Converters from its administrators for £502,899 in cash, through its wholly owned subsidiary Film & Foil Solutions. Coral said it had made an initial cash payment of £202,899, with the outstanding balance to be settled within 14 days following completion. The group said: “The cash payments have been funded without any increase to existing group facilities". Coral’s Film & Foil arm has also agreed to a six-month licence to occupy Arrow’s facility in Castleford, West Yorkshire, as it negotiates a long-term agreement. It has also taken on Arrow’s 55 staff and plans to run the business as a going concern, and has also acquired Arrow’s assets including flexographic printing machines, laminators, and slitting and punching facilities. Arrow is an approved supplier to UK supermarkets. It reported sales of £12.5m in the year to January 2022, £17.9m in the 18 months to July 2023 and current sales demand of around £1m per month. Joe Grimmond, Coral’s non-executive chairman, said "This acquisition propels Film & Foil into the front line of specialist flexible packaging and provides Coral Products plc with capacity toward its medium-term goal of £50 million of production availability."

President Trump's comprehensive global tariff package has triggered a steep drop in defence sector stocks, as markets grapple with the repercussions of his decision to slap a 10 per cent tax on British exports, among other actions. This move has sparked worries about increased costs and the potential for a scarcity mentality that could push up prices for essential materials in defence manufacturing, as reported by City AM. "There is just a general sense of panic", stated Daniel Murray, CEO of EFG Asset Management. He further noted that as the market responds to these trade tensions, "everything is getting killed, even good companies that will likely fare relatively well." Shares in major UK and European defence companies took a severe hit on Monday, with significant losses seen by BAE Systems, Chemring Group, Qinetiq and Babcock International. Babcock International's shares plummeted nearly eight per cent, closely trailed by Chemring Group, which dropped by 7.16 per cent. Babcock declined to comment on the situation. Meanwhile, British defence powerhouses BAE Systems and Qinetiq saw their shares dip four per cent and 6.41 per cent respectively. However, a spokesperson for BAE Systems told CityAM: "We have very limited imports into the US and as such we aren't materially impacted by the evolution of US tariff policy in the same way that some other companies are." Companies across Europe, including Germany's Rheinmetall and Hensoldt, experienced significant declines of up to 14%, reflecting a broader trend of investor uncertainty triggered by Trump's tariff announcement. Kevan Craven, chief executive of ADS Group, which represents UK aerospace, defence, security, and space companies, expressed concerns about the impact of the tariffs. Despite this, he remained optimistic, stating: "While the tariff announcement is disappointing, it will not kill our sectors. "However, our members forecast additional costs in the tens of millions of pounds, particularly in the aluminium and steel markets", he added. Craven warned that the tariffs could lead to increased costs due to businesses' instinct to stockpile, creating a scarcity mindset that could have long-term consequences. The tariffs, announced as part of Trump's 'Liberation Day' measures on Wednesday, are seen as an effort to address the US trade deficit with multiple countries, including the UK. The UK government has launched a request for input on potential retaliatory actions in response to these tariffs, with a deadline of 1st May for businesses to share their concerns. Earlier this year, shares of European defence companies were among the strongest performers, driven by expectations of increased government spending on regional security. Following the announcement of tariffs, the defence sector has seen one of its most significant declines in recent history – marking its largest single-day drop since the COVID-19 pandemic. The Stoxx Europe 600 index plunged by 6.3 per cent, with the defence sub-index dropping by 9.3 per cent early on Monday. Amid fears of a growing global trade war, markets have responded nervously. The wider European stock market also suffered substantial losses, with Germany's DAX falling ten per cent at the start of trading, while countries such as France and Italy also experienced corrections. The global tariffs come after Chancellor Rachel Reeves' recent Spring Statement, where she underscored the UK government's commitment to enhancing the UK's defence capabilities in light of increasing security threats. Reeves detailed plans to increase the defence budget to 2.5 per cent of GDP.

A Birmingham manufacturer has secured an exclusive supply deal with one of the UK's most-famous fashion brands. Dalian Talent has signed a five-year partnership with French Connection to supply its physical and online stores with licensed candles and home fragrances. Dalian, which is based in Kings Heath, called the deal "a significant milestone" in the company's 27-year history. The business makes candles for both private label and brand licensing for home fragrance, candle-related home furnishings and personal care products. Email newsletters BusinessLive is your home for business news from across the West Midlands including Birmingham, the Black Country, Solihull, Coventry and Staffordshire. Click through here to sign up for our email newsletter and also view the broad range of other bulletins we offer including weekly sector-specific updates. We will also send out 'Breaking News' emails for any stories which must be seen right away. LinkedIn For all the latest stories, views and polls, follow our BusinessLive West Midlands LinkedIn page here. French Connection enlisted the firm to expand its home fragrance category. The debut collection is being sold across the UK, Europe, India, America and the Middle East, as well as through digital channels, and features eight ranges and gift sets. The products are made using shea butter, harvested from trees in West Africa. The tie up has also seen the French Connection candles listed by high street fashion staple Next and on its website. Dalian's chief executive Hamish Morjaria said: "The development of the French Connection home fragrance range was a deeply collaborative process. "We worked closely with its design team to ensure the collection authentically reflected the brand's values, aesthetics and emerging trends….bringing the first collection to market in just six months." French Connection's chief executive Apinder Ghura added: "We are delighted to partner with Dalian Talent Group on this exciting venture. "We look forward to building on this momentum in the years ahead."

Global stock markets have tumbled while local manufacturers such as JLR and JCB have started assessing their business activities as President Donald Trump imposes a new raft of import tariffs. After being announced in February, the tariffs came into force over the past few days and have seen goods imported into the US from the UK hit with a baseline tariff of ten per cent. However, this rises to 25 per cent for all foreign-made vehicles entering the US, prompting Coventry-headquartered JLR to pause its exporting activities into America. And like JLR, Warwickshire sports car brand Aston Martin does not have a factory in America, meaning the fiscal implications could be even greater, especially as the US market represents around 30 per cent of its annual sales. The UK has got off light compared to the other countries and regions, with China being hit with a 34 per cent tariff, 20 per cent for the EU and a whopping 46 per cent for Vietnam - prompting fears of a 'global trade war'. Business leaders in the West Midlands have been reacting to the new tariffs coming into force and the potential implications going forward. Email newsletters BusinessLive is your home for business news from across the West Midlands including Birmingham, the Black Country, Solihull, Coventry and Staffordshire. Click through here to sign up for our email newsletter and also view the broad range of other bulletins we offer including weekly sector-specific updates. We will also send out 'Breaking News' emails for any stories which must be seen right away. LinkedIn For all the latest stories, views and polls, follow our BusinessLive West Midlands LinkedIn page here. Emily Stubbs, head of policy at Greater Birmingham Chambers of Commerce, described it as a "lose-lose" situation for everyone and urged the UK Government to do all it could to provide practical support to businesses now making difficult decisions about trading with the US. "We also encourage Greater Birmingham firms to immediately start negotiations with their US customers on managing the impact of these tariffs if their contacts allow," she said. "Longer term, they may want to explore alternative markets, especially the EU, countries in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership or those where we're expecting other trade deals to be made later this year. "The Bank of England cited intensified uncertainty in global trade as one of the reasons to hold off on lowering interest rates last month. They'll be carefully monitoring the impact of these tariffs, particularly on inflation and employment, as they consider future rate cuts. "A global trade war would likely give a significant knock to UK GDP and that could have repercussions for the Chancellor's fiscal headroom - if that gets wiped out then we would be looking at either more spending cuts or more tax rises. "The UK government must remain level-headed and continue to work with the US administration to find a mutually beneficial agreement on tariffs and trade." Janie Frampton, president of the Greater Birmingham Global Chamber of Commerce, said: "The ten per cent tariff on goods imported from the UK into the United States is unhelpful but is significantly lower than has been imposed on many other major US trading partners, including the EU. "However, there is no escaping the fallout from these decisions, which will increase the risk of trade diversion and cause great uncertainty for business communities across the world. "The Government has kept a cool head during negotiations so far and getting the best deal for the UK is what matters most. "It is vitally important the Government does not give up on negotiations and, in the meantime, provides the necessary support to impacted businesses. Tariffs can be lifted at any time and the US has left the door open to do some form of deal with us." David Morris is head of the Midlands operation for financial and business services firm PwC in Birmingham. "The announcement of tariffs will have a significant impact in the UK, and especially in the West Midlands, where we have strong manufacturing and automotive roots," he said. "This presents new and immediate challenges for business. Cars make up 49 per cent of the exports from the West Midlands to the US which represents five per cent of the region's GVA. "To successfully navigate through this uncertain period, business leaders will need to make strategic decisions which consider how they source, price and manage risk. Being agile and resilient will be essential. "Looking ahead, close collaboration across policy makers, business and education providers will ensure the West Midlands can continue to build on diversifying its offering - strengthening our professional and financial services and supporting our growing technology sector." David Hooper is the managing director of Hooper & Co, a Warwickshire-based international trade consultancy. He has warned UK exporters to review their export documentation urgently or risk being hit with tariffs of up to 54 per cent due to supply chain "blind spots". Mr Hooper said it was crucial firms were aware that tariffs would be applied based on the country of origin, not the country of export. "We're urging all UK exporters to immediately audit their supply chains and ensure they have robust documentation in place, especially when it comes to the origins of goods and any potential blind spots that could incur unexpected charges," he said. "A product made in China but re-exported from the UK will face a tariff of up to 54 per cent unless it qualifies under origin rules as having been substantially transformed in the UK. "If your paperwork doesn't prove UK origin, your goods could be incorrectly classified and your business could be hit with extra costs and delays. "With such short implementation timelines and variable tariff rates depending on origin, this is one of the most challenging compliance environments UK exporters have faced in recent years. UK businesses must therefore act now to protect their margins and avoid disruption. "UK manufacturers who can demonstrate clear origin have a potential competitive edge in the US market but only if they get their documentation right." Looking further ahead, he added: "China is expected to respond with countermeasures and the EU has already signalled its intention to introduce tariffs of its own. "UK exporters are entering a period of heightened regulatory complexity and trade volatility. It's so important they have a solid understanding of their current activity and processes to avoid any further headaches." Johnathan Dudley, is a partner and the head of the manufacturing team at accountancy group Crowe in Oldbury. He said it was vital for companies to focus on seizing opportunities to promote more UK and European manufacturing. "You cannot control what you cannot control so it's important for UK businesses to concentrate energy and efforts on what they can," he said. "For UK industries, including steel production, processing and the automotive supply chain, the tariffs come at a challenging time. "It'll be key for these industries to assess their options and explore diversification - particularly in light of the UK government's increase in defence spending and healthcare. "Outside automotive, a ten per cent tariff arguably gives UK companies a competitive advantage over those with higher tariffs such as the EU or China. "For all sectors, the opportunities of trading outside the USA present themselves - Canada and Mexico, for example, are vast countries with demand and resources." Separately, Staffordshire digger manufacturer JCB has confirmed it will double the size of a new factory currently under construction in Texas as the company says the tariffs will impact its business in the short-term. JCB has been manufacturing in the US for 50 years and in 2024 bought 400 acres of land in San Antonio after recognising the need to produce even more machines in North America. It currently has a plant in Georgia which it has operated for 25 years and employs around 1,000 people. The original plan for a 500,000 sq ft factory in San Antonio has now been revised up to one million sq ft at a cost of around £390 million. Production is due to start next year and it will employ up to 1,500 people. JCB chairman Anthony Bamford said: "JCB has been in business for 80 years this year and we are well accustomed to change. "The United States is the largest market for construction equipment in the world and President Trump has galvanised us into evaluating how we can make even more products in the USA which has been an important market for JCB since we sold our first machine there in 1964." Chief executive Graeme Macdonald said: "In the short term, the imposition of tariffs will have a significant impact on our business. However, in the medium term, our planned factory in San Antonio will help to mitigate the impact.

Soft drinks maker Fentimans has grown profits despite cost of living issues continuing to eat away at consumers' spending power. The Northumberland-based seller of botanically brewed drinks, including its ginger beer and rose lemonade, saw operating profits before exceptional costs rise from £97,153 to £1.38m last year, and a pre-tax loss of more than £655,000 converted to a pre-tax profit of £1.4m. New accounts filed for the Hexham firm show it managed to boost earning despite falling sales. Fentimans saw gross sales dip to £39.5m from £42.9m as turnover fell to £35.6m from £38.9m. Bosses said the gains had come thanks to significant cost savings made in the face of what it called a "challenging backdrop" with weakening demand. CEO Ian Bray said the business was tightly run and outlined a number of cost cutting measures including a glass light-weighting project; looking for efficiencies with suppliers; tight management of marketing budgets and continuous improvement of processes. Fentimans has previously voiced its concern about the impact on glass-bottled drinks producers posed by incoming rules that require them to fund the costs of recycling packaging waste, based on weight. Mr Bray also pointed to overseas exports helping build a solid foundation for the business. A breakdown of gross sales showed the UK saw a 6.4% fall to £20.2m as more promotional activity was needed to maintain volumes, which had been particularly effective over Christmas. Meanwhile gross export sales fell 8% to £16.1m as demand also waned in key international markets. Fentimans said it had changed several distributors with the aim of positioning itself for long-term growth. And in the US, gross sales plummeted from £23.8m to £3.3m - where the firm said there had been a reduction in volumes with existing customers. Within the accounts, the firm said 2025 is expected to bring a more stable inflationary environment but one with continued lacking demand. It plans to meet those challenges by expanding global distribution of its ranges. Mr Bray said: “This is a significant improvement on the previous year and a testament to the hard work of our fantastic team and quality of our products. We enter the new financial year with increased optimism despite some notable headwinds. Like all SMEs we are facing huge tax increases across the business this year, with the hike in employers' National Insurance, increases in the National Living Wage plus the introduction of an anti-competitive packaging tax on glass. "We will continue to push forward in 2025. This year will see us continue to focus on our strengths, with some exciting partnerships, product developments and opening more new international markets."

Shares in Rolls-Royce have begun to recover after shedding over £10bn in value following the announcement of President Donald Trump's tariffs. The Derby-based group's shares had reached an all-time high of 812p in mid-March before dropping to 635p on Monday, as reported by City AM. They have since started to bounce back, currently trading at around 666p, marking a 4.75 per cent increase. Despite the slump triggered by Trump's tariff announcement last week, it did not entirely erase the gains experienced when Rolls-Royce's share price soared from 606p to over 800p at the end of February and into March. This surge occurred as Rolls-Royce reinstated dividends and announced a £1bn share buyback programme after full-year profits significantly exceeded expectations. At the end of February, the FTSE 100 engineering behemoth proposed a 6p per share dividend for investors, its first payout since before the pandemic. This was announced as underlying profit hit £2.5bn, far surpassing a previous forecast of between £2.1bn and £2.3bn. Revenue of £17.8bn also outperformed analysts' consensus of approximately £17.3bn. On Friday, Rolls-Royce shares plummeted as much as 10 per cent amid escalating fears of a global trade war. The UK was hit with a ten per cent import tax during Trump's 'Liberation Day' speech, which set the baseline rate. The decline in the group's share price means the FTSE 100 giant is now valued at around £54bn. The last time it reached this milestone was in December 2024 and again in January of the current year. Rolls-Royce's share price has seen a partial recovery, contributing to the FTSE 100's opening 1.5 per cent higher this morning, bouncing back from losses over the past three trading days. Yesterday witnessed the FTSE 100 plunging more than four per cent as global stock markets grappled with the potential impact of a worldwide trade war. However, early deals this morning saw the market making a cautious recovery. The domestically-focused FTSE 250 leapt 1.6 per cent in early deals, while the Stoxx Europe index 600 climbed 1.4 per cent. Commodities-focused stocks on the FTSE 100 led the market upwards, buoyed by rising commodity prices. BP saw a 2.6 per cent increase, while mining companies Antofagasta and Glencore both rose by three per cent. US-focused tech stocks on the FTSE 100, such as Scottish Mortgage Investment Trust and Polar Capital Technology Trump, also posted strong performances this morning.

The latest UK Purchasing Managers' Index (PMI) from S&P Global indicates a deepening crisis in the country's manufacturing sector. S&P Global's most recent PMI survey, which gathers data from approximately 600 industrial firms about their performance, suggests that manufacturing is once again on a downward trajectory after a disappointing start to the year, as reported by City AM. The latest figure reveals a drop to 44.9, slightly better than the anticipated 44.6 predicted by economists. This represents the lowest reading in 17 months, compared to an average of 51.7 between 2008 and 2025. Rob Dobson, director at S&P Global Market Intelligence, described the outlook as "darkening" with confidence plummeting across the sector. Dobson stated: "Companies are being hit on several fronts." He elaborated: "Costs are rising due to changes in the national minimum wage and national insurance contributions, geopolitical tensions are intensifying, and global trade faces potential disruptions from tariffs." He added: "Although the impact on production volumes was widespread across industry, it was again small manufacturers that took the hardest knock." The manufacturing sector had already begun to falter in the new year. The Confederation of British Industry (CBI) reported a decline in output in January, suggesting businesses were "conserving funds" in response to Reeves' tax raid, which includes increases to national insurance contributions (NICs). Employer taxes are scheduled to be implemented starting this week, with the threshold for paying the levy lowered to £5,000.

Aston Martin is under threat of a takeover by Canadian billionaire Lawrence Stroll, who plans to increase his stake in the car manufacturer by £52.5m. Stroll's Yew Tree Consortium is aiming to purchase 75m shares in Aston Martin at a seven per cent premium, which would raise his ownership of the car manufacturer to 33 per cent, as reported by City AM. However, the UK Takeover Code stipulates that anyone acquiring more than 30 per cent of shares in a company must make an offer to buy out the remaining shareholders. This could potentially force Stroll, who also serves as executive chair of the firm, to take over the last remaining car manufacturer on British markets. Aston Martin stated in a stock exchange announcement this morning that the investment would depend on the takeover limit for the firm being raised to 35 per cent. This would be achieved by seeking a waiver from the UK Panel on Takeovers and Mergers, as well as a resolution from other shareholders in the firm. Aston Martin's stock price has plummeted 45 per cent in the last six months as investors worry about the impact of US president Donald Trump's proposed tariffs on non-American car manufacturers. On Thursday, when Trump announced plans to impose 25 per cent tariffs on all car makers, the firm was the worst performer in the FTSE 250, falling seven per cent. "Five years into Aston Martin's transformation, I remain highly confident about the company's medium-term prospects having re-positioned the company as one of the most desirable ultra-luxury high performance automotive brands," Stroll remarked. Lawrence Stroll initially acquired a stake in Aston Martin in 2021 after his Yew Tree consortium invested £182m, securing him a 16.7% share of the luxury carmaker. By 2023, Stroll had bolstered his holding in Aston Martin to 27%. Moreover, today Aston Martin announced its intention to divest its minority interest in its Formula One team for £74m, despite valuing the stake at £50.9m at the end of the previous year. Notably, Stroll's son, Lance Stroll, competes for the Aston Martin F1 team. The disclosure of Stroll's planned acquisition precedes the release of Aston Martin's quarterly financial results, expected later this month.

It was more bad news for UK auto last week when President Donald Trump announced 25 per cent tariffs on all car imports to the US. This will have a huge impact on the UK and EU auto industry which was already being squeezed by falling sales in China, stagnant demand in Europe and slow electric vehicle (EV) take-up. It's nothing short of a perfect storm for the auto industry. Cars are the UK's number one goods export to the US, at £8.3 billion in the year to the end of quarter three in 2024, out of around £58 billion in total UK exports to the US. Firms like JLR, Rolls Royce, Bentley, Aston Martin, Mini, McLaren and Morgan will be most affected. The US is the UK's largest auto export market after the EU. There will be a particular impact on the West Midlands which is the number one exporting region to the US (think JLR and Aston Martin, for example). Much of the UK auto industry is already operating well below capacity and the tariffs will be a further hit for a struggling industry. Production cuts and job losses are likely. The Institute For Public Policy Research puts 25,000 jobs at risk. Email newsletters BusinessLive is your home for business news from across the West Midlands including Birmingham, the Black Country, Solihull, Coventry and Staffordshire. Click through here to sign up for our email newsletter and also view the broad range of other bulletins we offer including weekly sector-specific updates. We will also send out 'Breaking News' emails for any stories which must be seen right away. LinkedIn For all the latest stories, views and polls, follow our BusinessLive West Midlands LinkedIn page here. That is a big underestimate as it fails to account for tipping points if plants fall below minimum viability levels and close completely, with a further impact on the supply chain. You can double or triple that number in terms of the jobs at risk. The UK is looking to do a quick trade deal with the US to avoid tariffs hitting UK auto too much. I think that is doable in a narrow sense on cars as the UK has a ten per cent tariff on US imports. Both sides could scrap auto tariffs completely and both would see it as a win. That has to be a key, immediate goal for the Government. A broader trade deal to avoid Trump's ten per cent tariffs on all UK imports will be much more tricky and will see the US wanting concessions on the digital services tax, more access for US services to the UK in areas like health, and a deal on agriculture. Think chlorinated chicken and hormone injected beef. The Government has already ruled out the latter. To help the auto industry, Prime Minister Keir Starmer this week set out changes to the UK's Zero Emission Vehicle (ZEV) mandate. This was set out as a response to Trump's 25 per cent tariff but was anyway on the cards after a huge outcry from industry last year over policy and a quick-round consultation by the Government. These changes have rather cleverly been marketed as a response to Trump's Tariffs. Nevertheless, what the Government unveiled is useful as far as it goes. The ZEV mandate policy had been inherited from the previous government and was a dog's breakfast of a policy which risked fining domestic producers for not hitting overly optimistic mandated targets, with them then likely having to buy credits from the likes of Tesla and Chinese EV producers. Fining firms making investment in the UK was always a bad idea and giving auto makers more flexibility to hit the targets makes a lot of sense. Another welcome change is allowing hybrids like the Toyota Prius or Range Rover Evoque hybrid to be sold through to 2035 (after the 20203 ban on pure petrol and diesel cars). Hybrids are a good first step for many people and help in the transition to electrification. And 2035 as a target for this is fine: the average life of a car is 15 years so that still means we can be on track to get to Net Zero by 2035. Other good news came in the form of reducing fines for non-compliance and exempting smaller producers like Aston Martin. So far, so good. But what isn't clear is whether there is any new cash for speeding up the roll out of the charging infrastructure. The Government ‘reaffirmed' £2.3billion for a range of objectives including infrastructure (in other words just reannounced money that was already committed). While the government says it is on track to reach its target of 300,000 public chargers by 2030, many of these are in London and the South East. Elsewhere, the charging network is patchy and a big deterrent to EV take up. There are also some glaring gaps in the new policy stance. Firstly, there are no incentives to boost demand for EVs. If the Government wants to speed up the market for EVs, whacking the supply side with a big stick in the form of mandates is not enough. Carrots are also needed for the demand side. Think of temporary VAT cuts to make EVs more attractive and boost demand. Sadly, the Government's self-imposed fiscal straight jacket rules this out. But, even if the UK gets a trade deal with the US, Trump's tariffs will hit world trade, growth and demand for UK exports. There will be indirect effects on UK economic growth anyway which makes hitting Rachel Reeves' eye-wateringly tight fiscal rules even more challenging. At some point, they will need to be relaxed. Last but not least, the Government's early-awaited yet delayed industrial strategy is needed sooner rather than later. It has been delayed by the Government while it is being repainted from green to battleship grey as the drive to re-arm gathers pace given Europe's inability to rely on the US for defence under Trump. Boris Johnson sadly scrapped the last industrial strategy so as to ‘build back better'. Building back badly was perhaps a more apt description of what then unfolded as growth stagnated. Putting a strategy back in place is vital to help advanced manufacturing - and automotive - on a range of issues like attracting investment into making EVs, rebuilding the supply chain (including on batteries), retraining and reskilling workers and cutting energy costs. Starmer has said the world has changed and we need to respond. It has, and while the Government's announcements this week are welcome, much more will be needed going forwards if the auto industry is to thrive in the UK.

A major UK cheddar cheese supplier is considering axing some 60 roles at its dairy factory in Cornwall. Saputo Dairy UK, which manufactures brands such as Cathedral City and Wensleydale, is looking to reduce its workforce by 80, with the majority of jobs being cut at Davidstow Creamery, near Camelford. The company told Business Live it was proposing to stop making a number of ingredients for the baby formula market and instead return to producing sweet whey powder. The proposed job cuts will have no impact on the supplying farms or cheese production, it added. "We will consequently be entering into a period of consultation with a group of employees regarding these proposed changes," a spokesperson said. "Market conditions are such that we are having to take difficult, but decisive, actions to simplify the business and introduce meaningful efficiencies to ensure we are best placed for the future. "We will ensure that all employees who may be impacted by this proposal are well supported." Saputo Dairy UK has manufactured ingredients for the infant formula market since 2013, but said on Thursday (April 3) that demographic shifts and changes in demand for different whey formats mean it was no longer in the company's "best economic interests" to continue servicing that market. The changes are expected to be completed by the end of September 2025. Dairy Crest was acquired by Saputo, one of the top dairy processors in the world, in 2019 and rebranded as Saputo Dairy UK. In 2021, Saputo snapped up Wensleydale Creamery, which manufactures, blends, markets and distributes a variety of specialty and regional cheeses, including Yorkshire Wensleydale cheese. In 2022, the company launched Cathedral City Plant Based - a dairy-free alternative to cheese.

Dairy producers Arla Foods and DMK Group are set to merge in a move that will create a €19bn revenue group. The farmer-owned groups say the move - which is subject to regulatory approval - will create the strongest dairy cooperative in Europe. It follows collaboration between the two organisations, who say the merger will create a solid supply of milk and give it the financial muscle to invest for the future. Jan Toft Nørgaard, chair of Arla Foods, said: "The foundation of this partnership is formed by our shared values, and I am immensely proud of this proposed merger, which is a win-win for our cooperatives. The strength of both Arla and DMK Group lies in our shared commitment to quality and innovation, and I see DMK Group as the perfect partner in shaping a new and strengthened Arla, poised to lead in the dairy industry." Heinz Korte, chair of DMK Group, said: “We are proud of the planned merger with Arla, a cooperative that shares our commitment to innovation and optimal value creation. This partnership strengthens the resilience of our cooperatives and significantly contributes to strengthening the competitiveness of our farmers. Together, we can expand our reach for our dairy products, thus improving our offering and jointly driving the further development of innovative products for the benefit of our members." Arla Foods, which has its UK head office in Leeds, has revenues of €13.8bn and employs 21,900 people. Meanwhile DMK, which has its headquarters in Zeven, Lower Saxony, has revenues of €5.1bn and employs 6,800. Peder Tuborgh, CEO of Arla Foods, added: "DMK Group is the largest dairy cooperative in Germany and a very attractive partner that shares our core values. Our strong market positions and product portfolios complement each other very well and our strong partnership in recent years has proven that DMK Group is an ideal partner for Arla.

The UK Government has announced a series of initiatives aimed at supporting the automotive industry amidst challenges posed by US tariffs and the transition to electric vehicles. Already lobbying for modifications to the electric vehicle mandate, the car sector was hit hard by the imposition of a 25% tariff on exports to the US. In response to concerns over potential job losses, the Government has introduced a range of measures designed to bolster this crucial sector. A key element includes easing the targets for electric vehicle sales, after Nissan highlighted that stringent goals could jeopardise the 'viability' of its UK presence, including its Sunderland plant. Prime Minister Sir Keir Starmer said: "Global trade is being transformed so we must go further and faster in reshaping our economy and our country through our Plan for Change. I am determined to back British brilliance. Now more than ever UK businesses and working people need a Government that steps up, not stands aside. "That means action, not words. So today I am announcing bold changes to the way we support our car industry. This will help ensure home-grown firms can export British cars built by British workers around the world and the industry can look forward with confidence, as well as back with pride. And it will boost growth that puts money in working people's pockets, the first priority of our Plan for Change." Business Secretary Jonathan Reynolds, said: "This pro-business Government is taking the bold action needed to give our auto sector the certainty that secures jobs, drives investment and ensures they thrive on the global stage. Our Industrial Strategy will back the country's high growth sectors, including advanced manufacturing, so we can grow the economy and deliver on the promises of our Plan for Change." In a move to support car manufacturers towards the 2030 target for ending the sale of petrol and diesel vehicles, changes have been made to the zero emission vehicle mandate that introduce increased flexibility during the transition period and extend the allowance for hybrid usage. Several smaller companies like McLaren and Aston Martin are set to benefit from exemptions within these targets. It has been reported that fines for manufacturers for each non-compliant vehicle sold will be lowered from £15,000 to £12,000. Nissan, which mainly exports its Sunderland-manufactured vehicles into Europe and therefore less susceptible to US tariffs, has revealed a trio of models—including the new generation Leaf, an all-electric Juke and the reintroduction of the Micra—all of which are expected to perform strongly in European markets. The company's recent publications showed a significant boost in its UK operations, with production scaling up to 325,000 vehicles and revenues climbing to £7.3bn in their 2024 accounts. Mike Hawes, CEO of the Society of Motor Manufacturers and Traders (SMMT) welcome the measures to support car manufacturers in the switch to electric vehicles as a '"really needed" step. Speaking on BBC Radio 4's Today programme, he said: "No one in the industry is denying that ultimately, we need to get to zero emission road transport but the underlying level of consumer demand just doesn't match those ambitious targets. It was a step that was really needed for this industry because the amount of pressure, financial pressure, that they're under from any number of global headwinds is severe at the moment." However, Robert Forrester, CEO of Gateshead-based listed motor retailer Vertu, said the Government's announcement "doesn’t really address the major issues". He said: “We have got 34 different global manufacturers and clearly the tariffs in the US have put most of those manufacturers under more pressure at a time when there was already pressure in the system. That’s why the Government has actually made this announcement. I’m not sure it actually goes far enough to address what will be quite significant issues in the years ahead. "The electric vehicle targets up to 2030 remain in place, the fines have been changed but it’s still a £12,000 fine for every petrol and diesel car up to 2030 that is sold above the zero emissions target - that’s billions of pounds to manufacturers - and manufacturers face a choice of either paying significant fines or rationalising petrol and diesel cars. Nothing has really changed here, this is real tinkering.

West Country-headquartered eyewear firm Inspecs says Donald Trump's tariffs are not expected to impact consumer demand and it is monitoring the situation "closely". The Bath-based company said its non-US-based businesses were not currently affected by the recent changes announced by the US President and that selective pass-through of cost increases would "largely mitigate" the situation. It also said it was focused on delivering operational efficiencies. Inspecs designs and manufacturers eyewear, frames and lenses, with many produced in countries such as China, which have been slapped with high tariffs by President Trump. The company only opened a new factory in Vietnam last year. "Notwithstanding the recently announced tariffs and caution in relation to market conditions, compelling new projects in the pipeline give us confidence in delivering on market expectations for 2025," said chief executive Richard Peck. In a set of unaudited preliminary results for the year ended December 31, 2024, Inspecs reported a group revenue decrease of 2% to £198.3m. Total operating expenses were reduced by 0.3% despite inflationary pressures, the firm said on Thursday, while underlying EBITDA - a measure of performance - reduced by 2.2% to £17.6m. Inspecs said it expected a "significant drop" in net finance costs in 2025 amounting to around £700,000 and that trading was in line with market expectations. "Inspecs demonstrated resilience in 2024 despite challenging macroeconomic conditions," said Mr Peck. "However, our continued focus throughout the year on the integration and simplification of our business has been significant. "We successfully got our new factory in Vietnam up and running, which has significantly improved our capacity. We also strengthened our brand portfolio by introducing several new brands and expanding our existing ones, all the while working on our supply chain and efficiencies. "Additionally, we have focused on growing our customer base in key markets. These strategic initiatives allowed us to improve our margins, maintain our administrative costs in an inflationary environment, and reduce our net debt, setting us up well for the future." Mr Peck said the first quarter of 2025 had "laid the groundwork" for a "pivotal" year for the company. He added: "As we move forward, the focus remains on sharpening efficiency, streamlining operations, and advancing key initiatives."

Shares in FTSE 100 heavyweight Rolls-Royce are on the rise, having now regained more than half of their value lost following President Donald Trump's tariff declarations. The Derby-based group's shares are currently trading at approximately 734p, marking an increase of over 10 per cent since the start of today's trading, as reported by City AM. This is a significant recovery from Monday's recent low of 635p. Prior to Trump's tariff announcement last week, Rolls-Royce shares had been trading at a record high of 812p in mid-March. The partial recovery coincides with a surge in the FTSE 100 – as markets opened this morning following President Donald Trump's tariff backtrack on Wednesday. London's blue-chip index saw gains of over six per cent – a rise of nearly 500 points. This followed the FTSE closing down three per cent yesterday, before Trump sent global markets skyrocketing with a 90-day halt on his 'Liberation Day' levies. Wall Street also made a comeback on Wednesday following the news. The S&P 500 rallied 9.5 per cent and the Dow Jones 7.9 per cent. The Nasdaq soared over 12 per cent as major tech giants reversed losses. Apple was up 15 per cent and Tesla 22 per cent. In other news, at the end of February, Rolls-Royce proposed a 6p per share dividend for investors, marking its first payout since before the pandemic. This came as underlying profit reached £2.5bn, significantly ahead of a previous forecast of between £2.1bn and £2.3bn. Revenue of £17.8bn also surpassed analysts' consensus of around £17.3bn.

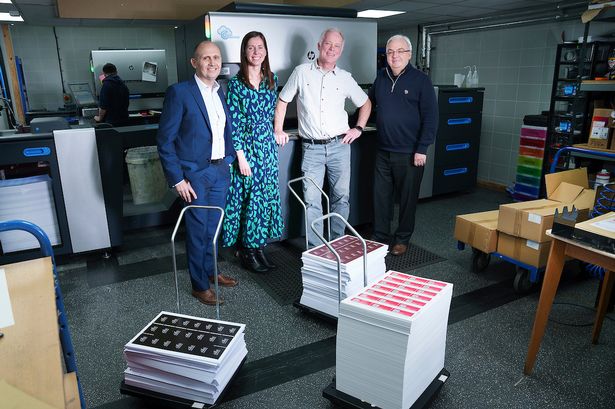

An identity card manufacturer has won a “six-figure” investment that it says will “future-proof” it for years to come. Company Cards Ltd, which trades as Swype, pioneered the digital printing of ID cards in the UK. The St Helens business was the first to beta test a digital printing press for Hewlett Packard 25 years ago – and will use its latest funding to invest in more HP equipment as it looks to continue its “significant sales growth”. Swype has won the funding through NPIF II – FW Capital Debt Finance, managed by FW Capital as part of the Northern Powerhouse Investment Fund II (NPIF II). The investment will be used to buy a new digital press and to expand into green and renewable printing options including PVC-free and even wooden cards. Swype's website showcases recent projects including membership cards for St Helens rugby league club and gift cards for Champneys health spas, with whom Swype has worked since 2012. Tim Scott, managing director and founder of Swype, said: “We operate in a very capital-intensive industry and all the machinery we use is expensive. It’s important that we remain at the cutting edge and this investment enables us to achieve this, enhancing and increasing our productivity, quality and capacity. “The new Hewlett Packard HP Indigo 7900 digital press will future proof the printing side of the business for the next 8-10 years. We’ve swiftly installed the press, modifying the room with no disruption to the day-to-day operations which has meant our clients have been able to take advantage of this seamless transition. We’ve found FW Capital to be very supportive and this investment will also assist our expansion into green and renewables card options with recycled PVC, board cards, wooden cards and PVC-free cards.” Barry Wilson, investment executive at FW Capital said: “With this latest printing press Swype are continuing a relationship they have had with Hewlett Packard for over 25 years. Using NPIF II investment we’ve been able to provide working capital support to help Swype invest in the business, expand their offering and product efficiencies with this new printing press. "It’s also exciting to hear about their plans to expand their eco-friendly card options too which is an area where demand is increasing. We look forward to following Swype’s progress over the coming months and years.”

Shares in the FTSE heavyweight Rolls-Royce plummeted by as much as 10% on Friday amid escalating fears of a global trade war. The global markets took a hit after China declared a 34% retaliatory tariff against the US. As a significant exporter of aircraft and marine engines, as well as power systems, Rolls-Royce saw its stock price drop to a one-month low of 682p, as reported by City AM. The company's operations are deeply integrated into the global supply chain, relying on components from various countries and distributing finished products across the globe. The FTSE 100 experienced a sharp decline of up to 3.8%, while the FTSE 250 dropped over three percent. During Trump's 'Liberation Day' speech, the UK was targeted with a ten percent import tax, which was set as the baseline rate. Russ Mould, investment director at AJ Bell, commented on the market situation: "With markets having suffered their worst week in five years, investors were hiding under their duvet on Friday hoping the pain would go away." He observed that the relentless selling persisted, with markets falling across Asia and Europe and futures prices indicating that the US would follow suit once trading commenced. Mould pointed out that "countless sectors" would feel the impact of the economic upheaval, but the complexity of the "moving parts" made it challenging to "know where to begin to comprehend the situation." The European markets also felt the sting of these escalations, with Germany's Dax dropping nearly five percent and France's Cac 40 plunging over four percent. In his speech, Trump declared a 20% tariff rate on EU imports to the US. The President stated that the "worst offenders" would face the highest levies, reiterating his claim that the US had been "taken advantage of."

A rather barren-looking former cement works site, nestled in the otherwise beautiful surroundings of Weardale, County Durham, is a critical part of what could be the world’s first entirely circular electric vehicle (EV) production cluster. The Eastgate works was demolished more than 20 years ago, but it is where Weardale Lithium has recently secured planning permission to build the country’s first lithium extraction facility. It hopes to take underground water - known as ‘geothermal brines’ - from beneath the North Pennines, before processing it to get lithium, a soft silvery metal which is ideally suited for use in batteries. The UK is estimated to need 15,000 tonnes of the stuff each year to feed the EV industry. Stewart Dickson is the former investment banker and mining expert who leads the business, which has already used grant funding from the Government’s Automotive Transformation Fund to complete trials of its technology. The company says that work has been highly successful, and it is now pressing ahead with multimillion-pound plans to build a demonstration plant next to nearby boreholes - where it will produce battery grade lithium carbonate on-site. Only 50 miles away on Teesside (“next door” in the minerals world), London Stock Exchange-listed company Alkemy Capital Investments is hoping to develop what it says is Europe’s largest low-carbon, lithium refinery. It hopes that facility can produce 15% of the continent’s requirements of lithium hydroxide - the next stage in the battery and EV supply chain. Lithium carbonate is the feedstock for that process and while not all of the Weardale-derived compound will go to Teesside, the two firms are already working together to create a supply chain. With these two projects set up, North East lithium can then be taken to AESC’s gigafactories in Sunderland, made into batteries which are then put into vehicles at the nearby Nissan plant, before lithium is extracted from end-of-life batteries by Altilium Metals - which has been working in the region and has plans to build a facility on Teesside. Newcastle’s Connected Energy is also pioneering the use of second life batteries for storage systems. Colin Herron, a prominent voice in the electric vehicle industry and heavily involved in the Faraday Institution, is energised by the possibilities - and says an all-encompassing industry in the North East is possible within two years, pending commercial agreements coming to fruition. “We can present to the world - and we are - that this region is utterly unique in being able to do this,” Mr Herron says, having taken that message to trade shows as far afield as the US and Japan. “You’ve only got to go from Stanhope, up to Newcastle and across to Teesside - that’s it. That triangle there will have absolutely everything in it, including the car manufacturer and the battery manufacturer.” In Weardale, the brines are said to be low in impurities - a factor that has excited US science and tech giant KBR, which is providing the technology licensing and proprietary engineering design for the County Durham plant. KBR’s involvement is seen as a coup for Weardale, meaning it can offer a one-stop-shop solution for turning brines into lithium carbonate - a rarity in the market. The $7bn revenue operator - which has a hand in everything from fertiliser projects in Angola to engineering for NASA satellites - brings capabilities to the project that Weardale’s nascent competitors do not have. You have to travel about 450 miles south, to Cornwall, to find the competition. Here Cornish Lithium and GEL are looking to do similar things, though Weardale’s operation is said to be larger and already has a march on the planning front. Mr Dickson expects the project to break ground this year with the first lithium carbonate emerging from the site next year. “It’s a very fast-paced development, but we think the project merits that. I’m sure it won’t be a straight road because what we’re doing is innovative and it's new. So, we’ll have to be agile along that journey. It’s very much a scaled, stepwise approach.” The undertaking is an enormous one, and requires sizable investment. The recent planning success has provided a boost, giving more surety to potential backers. In 2023, Cornish Lithium secured £24m of backing from the UK Infrastructure Bank - now the National Wealth Fund - and while Mr Dickson says such investment in the Eastgate plant is unlikely at this stage, there are conversations taking place that he hopes will pave the way for future injections. There are frustrations though - and Mr Dickson says this Government and the last have so far “not adequately resourced policy” around batteries and UK critical minerals. With key minerals such as lithium shaping up to become the “next economic battlefield” in a more geopolitically precarious world, Weardale’s home-grown approach comes with compelling national security and capital efficiency selling points. And it’s not only money needed to get the project off the ground. Skills are another urgent demand. Weardale has talked of its commitment to hiring locally, but admits that at least some of the jobs will be recruited globally. “Isn’t that exciting?” says Mr Dickson, who sees the challenge as a positive one. “New science, technology and engineering, green jobs that are ready for future-facing businesses. "But, that brings with it a new set of challenges. We’ve already done the preliminary scoping of the number of jobs that we’ll need and the roles, and we have an ambition to hire locally. That will require some upskilling of people already in the labour force and also new skills for people coming into the labour force.